Dan Ariely, the Israeli professor of psychology and behavioral economics at Duke University and best-selling author, is no fan of the insurance industry.

“Basically, if you try to create a system to bring out the worst in people, you would end up with one that looks like the current insurance industry,” he says, referring to the system in his adopted country of the United States.

Ariely therefore agreed to become “chief behavioral officer” at Lemonade, an Israeli startup that is trying to make the process of obtaining homeowners’ and rental insurance a lot less terrible.

The company’s two cofounders are Shai Wininger, who was behind Israeli powerhouse Fiverr, and Daniel Schreiber, formerly president of wireless charging technology maker Powermat and now Lemonade’s CEO.

Lemonade’s head of content and communications Yael Wissner-Levy explained to ISRAEL21c that the main reason insurance brings out the worst in people is that the insurance companies and consumers have competing aims.

A homeowner or renter just wants compensation if his or her apartment is burgled or damaged in a storm. The insurance company, on the other hand, will do everything it can to make it difficult for policyholders to get their money.

“They will put you through a maze of hurdles and paperwork and faxes,” Wissner-Levy said. “Even though you’ve paid your premium, every time they pay out a claim, it’s a dollar less to their bottom line.” If the process is hard enough, the thinking goes, perhaps you’ll simply give up.

The result is frustrated consumers who are incentivized to embellish their claims. “They’ll add another $100 or another 0 to the amount because they know they won’t get back their entire claim,” Wissner-Levy said.

Indeed, 24 percent of consumers say it’s acceptable to pad an insurance claim, according to the Insurance Research Council. That results in “premiums [that] go up while getting paid becomes a nightmare,” Ariely adds.

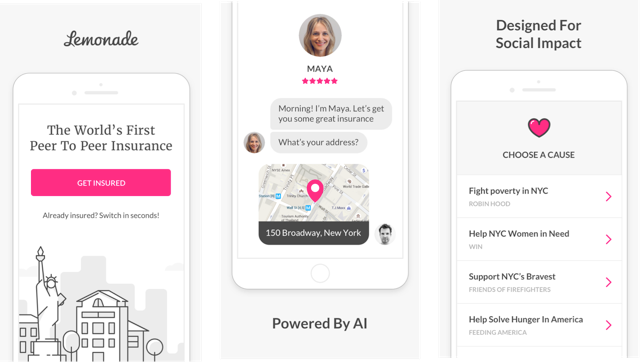

Lemonade flips the process in favor of the consumer, typically paying out claims without questions and immediately. It’s all handled by the Lemonade smartphone app. If your apartment is broken into, you simply scan the police report, take photos of any damage and record a video of yourself explaining what happened.

Lemonade then runs “18 anti-fraud algorithms that go through your claim,” Wissner-Levy said. “If it’s legitimate, it’s paid instantly, within three seconds.” If a claim doesn’t pass the software, a live person will get involved. “Sometimes it’s just some details that need to be ironed out.”

Lemonade communicates with its users through “Maya,” an artificially intelligent chat bot. Maya is there when you sign up, too.

We tried it out ourselves. Maya asked us a number of questions, such as where do we live, do we rent or own, do we have roommates, is there a fire alarm, do we own any “valuable stuff?” Within about 90 seconds, Maya offered us a policy on the spot – no appraiser required. If we weren’t just kicking the tires, we could have entered a credit card and been insured right then and there.

Lemonade’s premiums include 20 percent to run the company and 20% for “reinsurance” –third-party protection from companies such as Lloyd’s of London to ensure there will be enough money for a claim if a hurricane causes intense damage. The remaining 60% goes to paying out claims. If there’s anything left at the end of the year, Lemonade donates it to a charity of the consumer’s choosing.

This “giveback,” as Lemonade calls it, is critical to the company’s corporate DNA. Lemonade is registered as a “B-Corp” in the US – a relatively new designation that allows “the public benefit” to be a charter purpose for a company in addition to the traditional corporate goal of maximizing profit for shareholders.

“We’re committed to social good; it’s part of our business model,” CEO Schreiber told Wired magazine.

The giveback has its roots in behavioral economics. “Knowing that fraud harms a cause that you believe in, rather than an insurance company that you don’t … brings the best of human nature to the table,” says Ariely. “The upshot is greater trust. Everyone wins.” And consumers don’t add those extra 0s to their claims.

With its simple sign-up and pay-out functionality, spiffy mobile app and pro-social attitude, Lemonade is targeting millennials (81% of its customers are between 25 and 44 years old), most of whom are new to insurance.

“Almost 90 percent of our policyholders did not have insurance before,” Wissner-Levy tells ISRAEL21c. “We’re not against traditional insurers. There’s room for everyone. We’re serving the underserved.”

Lemonade has raised $60 million from investors including Sequoia Capital, Google Ventures, General Capital and Ashton Kutcher’s Sound Ventures. The company, which is a licensed broker in New York, California and Illinois (the three states in which it’s currently operating), has a staff of 35. Headquarters are in New York with R&D in Tel Aviv.

Lemonade’s quest to turn sour lemons into sweet lemonade is catching on. The company now has 14,000 paying subscribers.

Lemonade’s cofounders like to describe what they’re building as “a tech company doing insurance, not an insurance company doing an app.” With “insuretech” one of the hottest sectors in business today, that distinction may make the difference to Lemonade’s millennial target audience.

https://www.youtube.com/watch?v=6U08uhV8c6Y&feature=youtu.be

For more information, click here.