Entrepreneur enthusiasm has been ignited in leading nations now that widespread vaccinations have sparked economic activity.

The pursuit of new business opportunities is gaining as great changes challenge societies and ample investment money makes launching an idea all the more enticing.

“During a crisis that sheds light on problems brushed aside in peacetime, the number of people who find business opportunities and set up companies increases,” said Gen Isayama, general partner and CEO of World Innovation Lab (WiL), which invests in startups in the US and Japan. “The birth of companies that will cause revolutionary changes by way of the coronavirus pandemic, a once in 100 years crisis, is highly likely.”

At stake is whether today’s business-opening fervor can be further boosted and sustained by policy measures.

American startup Apollo Medco in Atlanta, Georgia, has developed an antigen COVID-19 testing platform capable of reporting results to tested persons’ smartphones within 15 minutes after a cotton swab sample is collected from a nostril. Some airports in the US have adopted the system on a trial basis.

The test can be done as easily as a cup of coffee can be bought, said Ken Dunwody who founded Apollo Medco in June 2020.

There were 1.52 million applications for starting new businesses in the US in 2020, up 16% from the previous year and the largest number in 14 years, the US Census Bureau said. The data covers only applicants planning to hire workers.

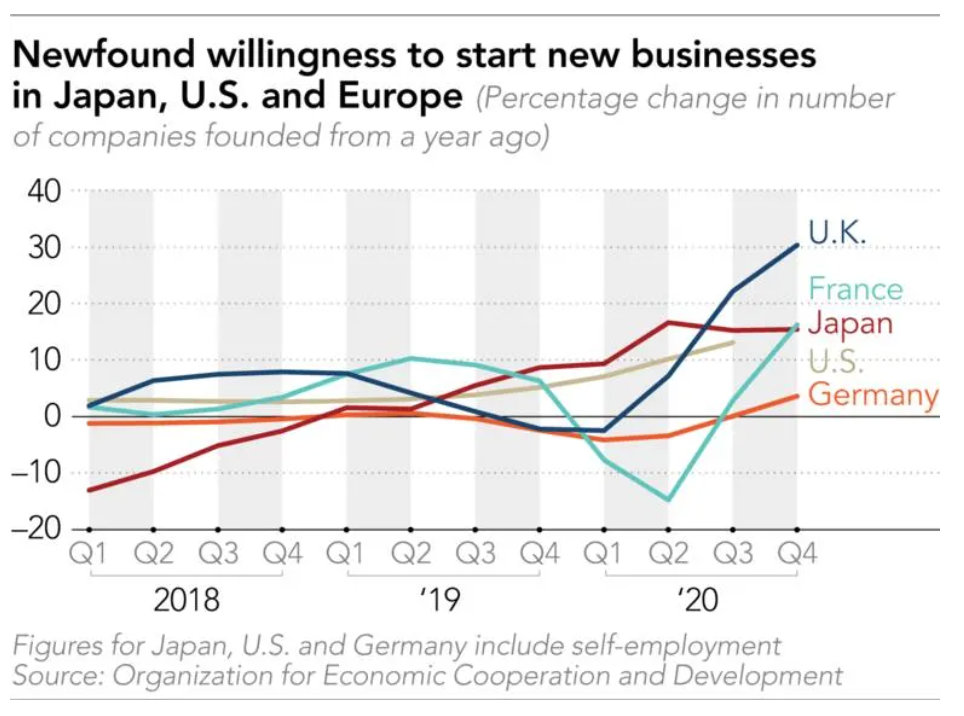

New business launches are also showing V-shape recoveries in the UK, France, and Germany. They plummeted in February and March 2020 as COVID infections soared, according to the Organization for Economic Cooperation and Development. In Japan, startups have kept launching at an increasing pace since early in the pandemic.

The coronavirus crisis has changed the way many of us live and work, but it also altered the startup landscape in similar ways as entrepreneurs now mind the “departure from big cities” that former office dwellers have embarked on.

Telecommuting, cloud services, and shared office spaces helped to scatter team members away from central locations after the virus made it dicey for them to conglomerate. The discovery of how easy it is to work from anywhere has drastically reduced the number of hurdles entrepreneurs would often run up against in less urban areas.

In the US in 2020, the number of applications for starting businesses jumped nearly 50% in the southern states of Mississippi and Georgia. In contrast, California, home to a large number of startups, and New York logged much smaller increases, of 10% and 3%, respectively.

The opening of startups in off-the-beaten-path Japan is increasing as well. The number of identification numbers allotted by the National Tax Agency to all business enterprises in Tokyo decreased 3% in the first quarter of 2021 from the year-earlier period but increased in Hokkaido, Kyushu, and Okinawa. In many regions other than Tokyo, the number began to increase around the July-September period of 2020, when COVID infections went on a march.

Donguri Pit was founded in Nisshin, an Aichi Prefecture city with a population of 90,000, in July 2020 to “eliminate food loss.” It installs shared refrigerators in community halls and other places to enable households and farmers to easily buy and sell surplus food and misshapen farm products. Donguri is preparing to raise funds so it can expand more quickly.

“We are now able to raise funds without going to Tokyo,” said Shinya Kuriyama, a representative of Keyes, a developer of smartphone-based systems to remotely control padlocks in the city of Fukuoka.

He spoke with a sense of surprise.

Founded in 2018, Keyes by April had raised JPY 100 million (USD 902,771) from venture capitalists and other investors after video conferencing with them.

Keyes shows how the disadvantages of launching new businesses outside of major cities have faded away thanks to “new normal” practices like Zoom calls.

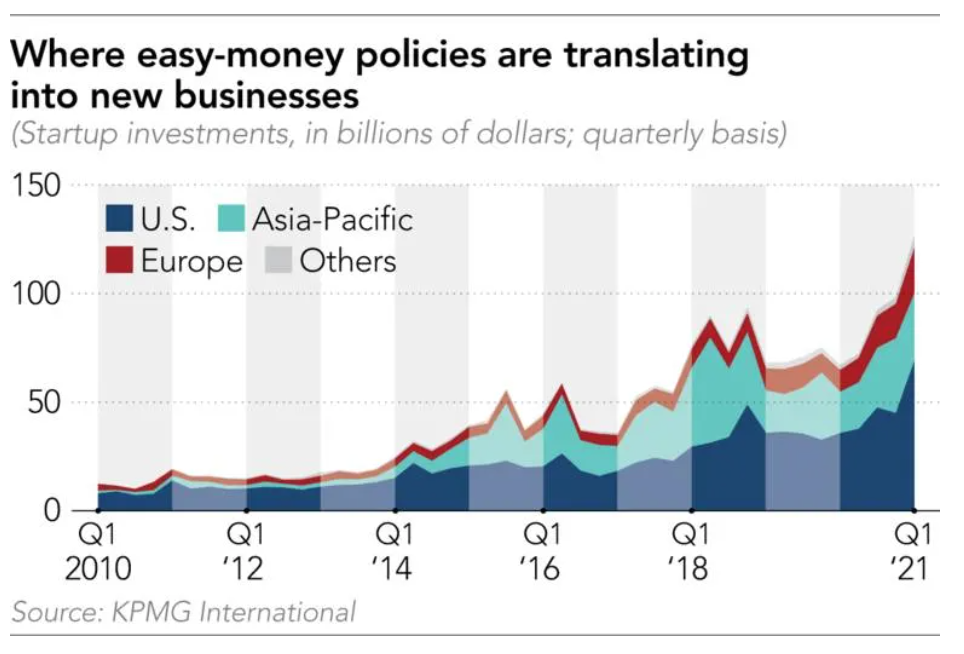

Entrepreneurs are also encouraged by an unprecedented availability of surplus funds. Central banks in major countries have instituted easy-money policies that have caused long-term interest rates to plunge. Standby capital held by American venture capitalists in 2020 doubled from five years earlier to USD 151 billion due to increased inflows of funds in pursuit of higher returns.

Investment in startups has also kept increasing in Japan. According to KPMG, it more than doubled in the January-March quarter from the corresponding period five years earlier to JPY 75 billion.

Measures against COVID-19 have pushed stock and commodity prices into bubble territory, but they have also been creating an unexpected byproduct that gives next-generation entrepreneurs supportive nudges forward.

This article first appeared on Nikkei Asia. It’s republished here as part of 36Kr’s ongoing partnership with Nikkei.