Cloudwalk Technology is set to be the first of China’s “AI dragons” to be listed on a stock exchange. Its IPO application has been accepted by the Shanghai Stock Exchange, according to EqualOcean.

Cloudwalk submitted its prospectus to the Shanghai Stock Exchange in November 2020 and had eyes on launching an IPO by the end of last year. It intends to raise RMB 3.75 billion (USD 579 million) by going public on the Star Market. The company has a valuation of RMB 25 billion (USD 3.9 billion).

Cloudwalk, Yitu, SenseTime, and Megvii are collectively called China’s four “AI dragons.” Unlike the latter three, which were founded as private enterprises, Cloudwalk was incubated at the Chinese Academy of Sciences (CAS). Its founder and president, Zhou Xi, was a professor at CAS’ Chongqing Institute of Green and Intelligent Technology between 2011 and 2015 before he formed Cloudwalk.

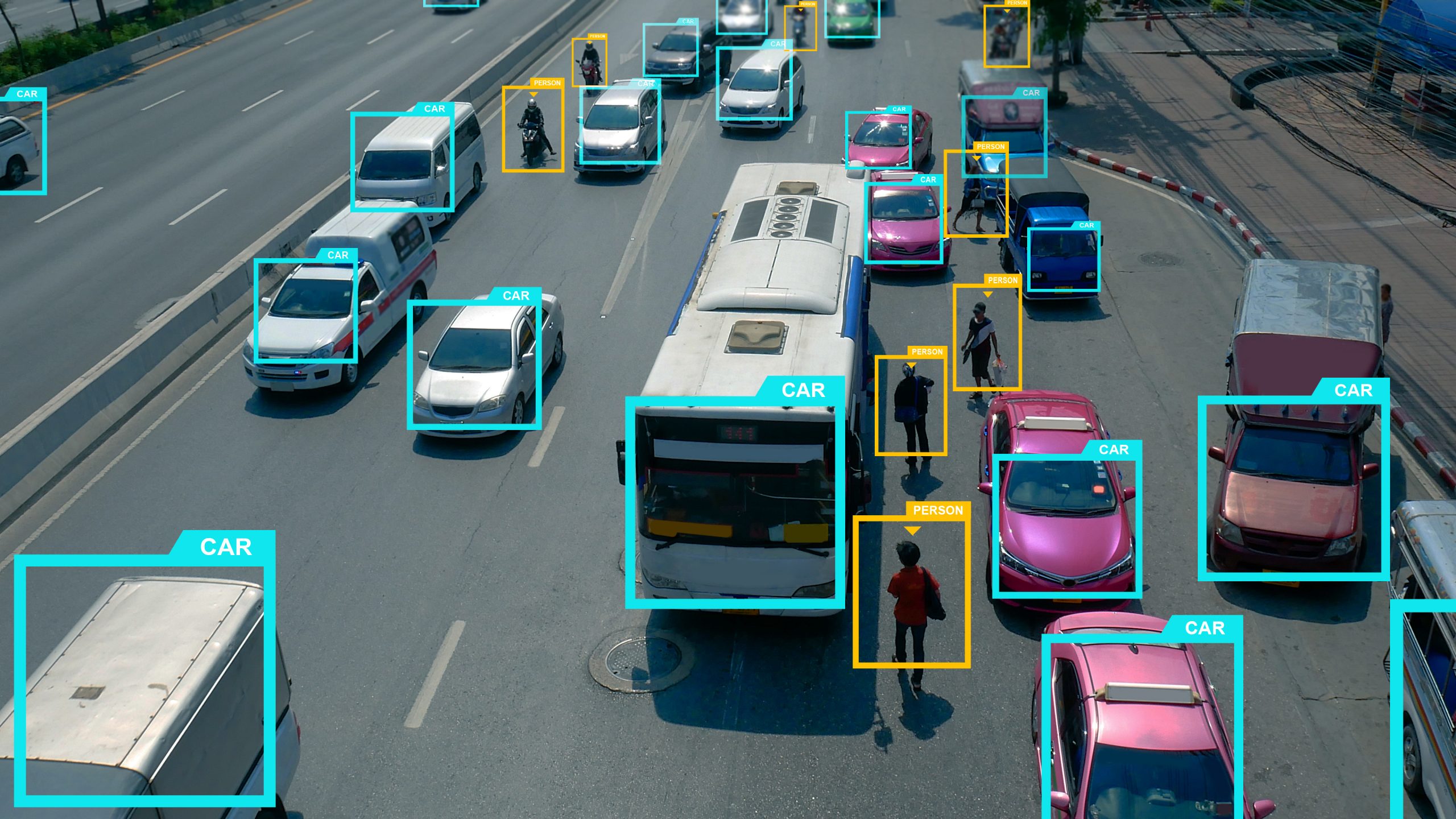

During his tenure at CAS, Zhou led a team of researchers who developed new products like AI-driven image recognition hardware, as well as algorithms that could sift through and establish correlations within troves of data that contain tens of millions of faces. In 2014, Cloudwalk developed China’s first payment system that utilizes facial recognition, drawing inspiration from a similar setup formulated by a company in Finland.

Cloudwalk has numerous state-backed funds as investors, including funds based in Fujian, Guangzhou, and Beijing. The company counts state-owned enterprises as clients. The Bank of China, Agricultural Bank, China Construction Bank, and Bank of Communications all use its facial recognition system. Cloudwalk’s hardware is also deployed in airports, train stations, and other public security contexts.

Like many companies that develop cutting-edge AI applications, Cloudwalk is not profitable. According to Cloudwalk’s prospectus, the company ran an aggregate net loss of RMB 2.58 billion, or USD 398 million, in the three years from 2018 to 2020. Its financial state, as well as regulatory adjustments related to personal data, may be obstacles on the road to going public. Global chip shortages may also slow down client adoption of AI and computer vision products.

The other three “AI dragons” of China are in different stages of seeking ticker codes. Yitu submitted an IPO application to be listed on Shenzhen’s Nasdaq-style ChiNext board but suspended the process in March. Alibaba-backed Megvii let its application with the Hong Kong Stock Exchange lapse in 2020 and is waiting for processing that may lead to a ticker on the ChiNext board. Computer vision developer SenseTime bumped back its IPO plans after it was placed on the United States Department of Commerce’s Entity List in October 2019 but is reportedly seeking a dual listing in mainland China and Hong Kong.

Artificial intelligence and its applications are a core component of the Chinese government’s drive to develop a high-tech nation. Even though the country’s researchers had a late start in developing homegrown AI solutions, Chinese entities now hold 74.7% of patents related to AI, according to the China Artificial Intelligence Development Report 2020.

Read this: China’s four tigers of AI tech are torn between hyped valuations and profitability