Foxconn, the world’s largest contract consumer electronics manufacturer and the biggest supplier to Apple, has long dreamed of building cars.

“If we can make iPhones, why can’t we make EVs? It is an iPhone with four wheels,” founder and former chairman Terry Gou told internal meetings more than once, according to people at the meetings.

Gou backed an internal project in 2014, code-named “A-Fu Initiative,” to build a prototype of a complete electric vehicle, Nikkei Asia has learned. The project, which was not reported at the time, was led by a Foxconn group in charge of precision instruments. Gou promised to award shares to employees involved if they were successful, said one person familiar with the plan.

The A-Fu initiative was short-lived—carmaking was more complex than expected—but the dream never died. Now Foxconn is in the middle of a new push into EVs. It is doing so just as the automotive industry’s rigid, century-old pyramid-shaped supply chain, where carmakers sit at the helm with tiers of suppliers underneath, appears on the cusp of a radical transformation. Will it be more successful this time?

Young Liu, who took over from Gou two years ago, has vowed to have Foxconn’s designs, components, mechanical parts, or software inside 5% of global EVs by 2025. But the company has bigger ambitions. It has announced plans to build factories in the US and Thailand that will assemble whole vehicles, and is looking for locations to build cars in Europe, too.

Meanwhile, it has put itself at the center of an industry initiative to develop new technologies and standards for EVs that could challenge traditional carmakers.

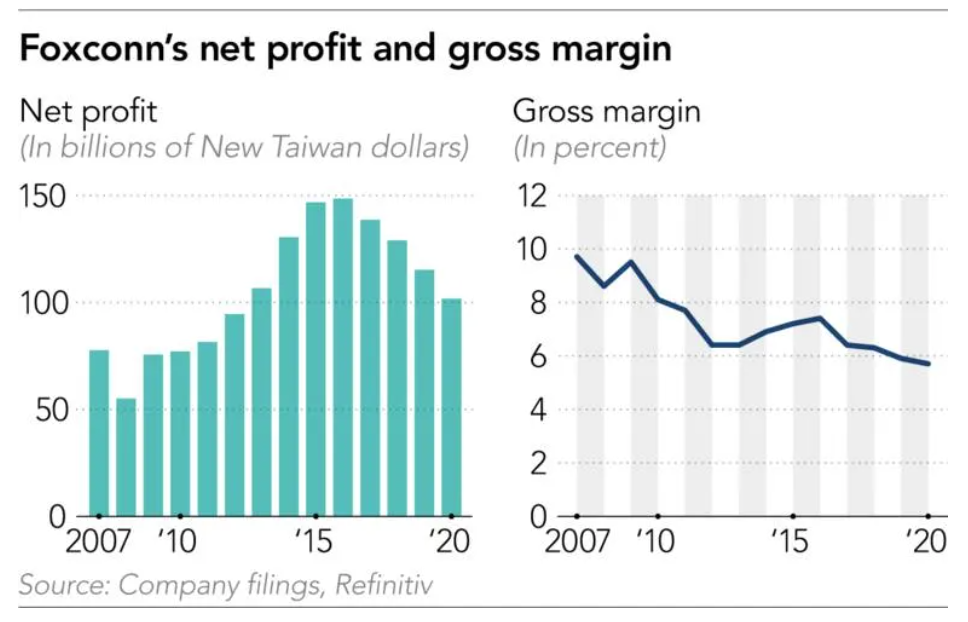

The developments come against a backdrop of declining profits from consumer electronics. Foxconn’s sales grew just 0.3% last year, and net profit has been shrinking since 2017. EVs are crucial if the company is to boost its gross margin from the current 6% to 10% as targeted. Optimism over its EV push spurred Foxconn’s shares to a four-year high in March and they are still up more than 15% since the start of the year. The stakes are high if its EV ambitions stall again.

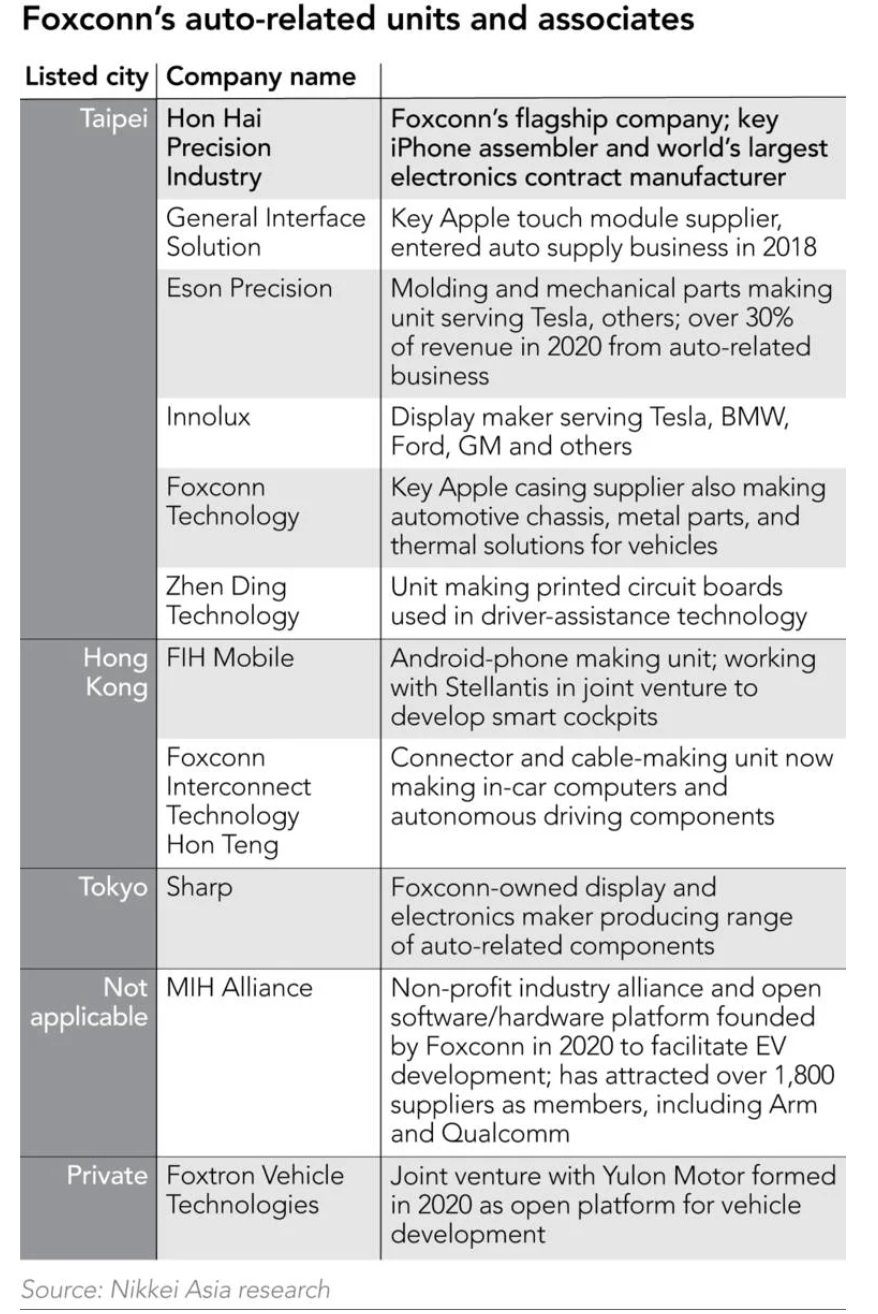

Foxconn’s subsidiaries already supply electronics to many traditional and electric carmakers, from Tesla to BMW, with products ranging from dashboard displays to printed circuit boards plus a host of mechanical and plastic parts.

To expand its product set and gather broader know-how, Liu has signed a rash of supply deals and technology development partnerships in the past year and a half. A joint venture with Stellantis, owner of Fiat and Chrysler and the world’s fourth-largest automaker, is developing cockpit software for connected cars. A joint venture with Geely of China, launched in January, aims to sell manufacturing and consulting services related to intelligent drive systems, software platforms, and even whole vehicles.

Foxconn has been racing to improve its expertise in software—a weak spot for a company known internationally for its hardware capabilities—through its subsidiary FIH Mobile, which has historically made Android phones.

And earlier this month it bought a semiconductor facility in Taiwan to gain more control over the supply of chips needed for EVs.

The company estimates its revenue from automotive components—excluding display panels used in vehicle telematics—could exceed TWD 10 billion (USD 359 million) in 2021. That remains marginal in a manufacturing empire that generates more than TWD 5 trillion a year, but it represents growth of 40% on the year, according to the company.

“The current revenues are mostly from mechanical and plastic parts, but we would expand our reach to the system and module level, and start to build the whole car in the near future,” Liu told an investor conference this month.

That is the prize: the whole car.

For decades, conventional auto companies competed on heavy investments in engines, transmissions, and complex powertrain systems, which worked as significant barriers to entry. But making an electric vehicle is less complicated, tempting a rash of startups globally to try.

Foxconn plans to replace the traditional tier-one suppliers and make whole EVs for newcomers such as New York-listed Fisker and China’s Byton, and traditional carmakers looking to transform into EV companies, like Taiwan’s Yulon Motor.

New entrants keep coming. Xiaomi, a longtime electronics manufacturer that entered the smartphone market in 2011 and is now the second-largest player behind Samsung and ahead of Apple, plans to introduce smart EVs under its brand by 2024. Baidu, the Chinese search engine and internet giant, has a joint venture with Geely and plans to do the same.

Perhaps the biggest opportunity of all would be Apple. Foxconn, which assembles more than 60% of iPhones globally, is widely assumed to be a candidate to produce Apple cars.

For the time being, its fortunes are closely linked with those of several ambitious but risky startups, who are more willing to work with emerging suppliers than established carmakers are. Byton, founded by executives from BMW, came close to running out of money before inking its partnership with Foxconn in January. Fisker is yet to start production of its first model, which will be made by Magna International, an established tier 1 automotive supplier. Its Foxconn vehicles will not roll off the production line until 2023.

Foxconn is leading an effort to smash the traditional automotive supply chain pyramid. Liu last October launched what Foxconn called an “open EV alliance” of software and hardware players in the automotive industry. The MIH Consortium—MIH stands for “Mobility in Harmony”—aims to set industry standards and develop “kits” combining hardware and software that EV makers can use to slash the development time and cost of new cars.

The consortium has already attracted more than 1,800 companies, including Qualcomm, Microsoft and the world’s largest battery maker Contemporary Amperex Technology, or CATL. While it has issued more announcements than products at this early stage, it unveiled specifications for its first EV software and hardware kit in January and plans to deliver it to automakers later this year. Foxtron, a joint venture of Foxconn and Yulon Motor, has used the MIH platform to design a prototype electric bus for a southern Taiwanese transit operator, which will hit the road next year.

“What MIH is trying to do is to make a similar chain of partners, just like how conventional carmakers built up their supply chains,” said Shinpei Kato, founder and chief technology officer of Tier IV, a Japanese autonomous driving software startup that is a key player in the consortium.

But, he added, “in the conventional supply chain, only carmakers at the top of the pyramid could make decisions.” That is changing. In EVs, key components such as motors and batteries are controlled via software, unlike highly mechanical engines designed from the top of the pyramid, he said.

That suggests components can be packaged together in bigger modules and integrated as subsystems, making them easier to assemble, just as smartphone development and production are achieved today, potentially giving more power to suppliers working in concert.

“Participating companies can make decisions together,” Kato said. “We might no longer need mega global automakers to produce cars when it comes to EVs.”

Read more: Xiaomi’s venture into EVs is a rough road, but it might have what it takes to succeed

There are questions about how MIH will evolve and to what extent, ultimately, it will benefit Foxconn.

“Component suppliers could enter the EV supply chains faster through the MIH consortium, while Foxconn could also gain access to various suppliers to strengthen its competitiveness in the EV industry,” said Chiu Shih-fang, an automotive electronics analyst with the Taiwan Institute for Economic Research (TIER), who has tracked Foxconn for a long time.

“But whether MIH could work or not still depends on the suppliers’ real technological capability.”

MIH also became a registered nonprofit foundation last month, meaning it no longer belongs to Foxconn, and its members are not subservient to the company.

As the automotive supply chain pyramid breaks apart, it remains to be seen who will be Foxconn’s partners and who will be its rivals.

Foxconn is not the only tech player wanting to catch the once-in-a-lifetime opportunity from electrifying the automobile industry, and each tech company has different anchor points in the EV supply chain.

Nidec, which announced in July that it is in talks to form a joint venture with Foxconn next year, is another example of an auto supplier seeking to play a bigger role. It is the world’s largest motor manufacturer, whose products are used in everything from computers, smartphones, and refrigerators, and it has publicly proclaimed a target of supplying 45% of EV traction motors in 2030.

Foxconn’s peers Quanta Computer and Pegatron have been supplying electronic control units to both traditional automobile and EV makers. And Delta Electronics, the world’s leading power management solutions provider, has been focusing on providing power, charging, thermal and motor management systems for EVs for more than 10 years.

None of these has expressed an ambition to build whole cars. But LG Electronics, the South Korean giant, has been deepening its relationship with Magna. Their joint venture has featured in speculation regarding who might build a car for Apple.

Meanwhile, traditional carmakers at the top of the old pyramid retain a formidable position, and not just because of their brand recognition. They also have skills and experience that will be hard for others to replicate.

Making an EV may be simpler than making a traditional car, but it is more complex than making an iPhone. It involves at least 10 times more components—and it has much higher safety requirements than handsets because, after all, car safety is a matter of life and death.

Those automakers, watching how Foxconn’s EV projects unfold, “probably believe Foxconn doesn’t understand how the industry works,” said Sanshiro Fukao, senior fellow at the Itochu Research Institute.

“An automaker has the capacity to pull together these components and certify safety,” he said. “Foxconn may believe that the gathering of tier 2 suppliers would help this process, but that is not right.”

Other analysts who express caution about Foxconn’s ambitions argue that the development cycle for automobiles is much longer than consumer electronics, and building automotive production lines is not the same either.

Raymond Tsang, a Shanghai-based partner at consultancy Bain & Co, points out that cars are typically offered with more options for customization. Customers can order specific colors, interiors, paid options, and so on, so a production line will have to make cars to unique specifications, compared with a more standardized smartphone assembly.

TIER’s Chiu said there is room for plenty of winners as the automotive industry undergoes its seismic shift from old technologies to new. “The era of the E … creates new possibilities,” she said. “The ways to make vehicles are different and there are various business models. Traditional manufacturers and new entrants will find their position. The market will be big enough to house all the players.”

Foxconn’s chairman Liu views the EV push as a way to build his own legacy after taking the baton from its iconic founder Gou, two people close to Foxconn’s management team told Nikkei Asia.

The blizzard of partnership deals he has signed, especially with Stellantis, Geely, and Fisker, will help Foxconn achieve experience of vehicle production, obtain economies of scale, and secure components like batteries, said Soumen Mandal, a research analyst covering automobile and emerging technologies for Counterpoint Research.

“With this gained knowledge, Foxconn will have to deliver some best-in-class products to gain the trustworthiness and credibility of big [customers],” he said. “Including Apple.”

This article first appeared on Nikkei Asia. It’s republished here as part of 36Kr’s ongoing partnership with Nikkei.