Ever since markets first opened around the world, initial public offerings (IPOs) have been a great way to access capital. In India, the first wave of the IPO boom was set off with liberalization in 1993. Data shows that there were over 2,000 IPOs between 1993 and 1994, which set the stage for the future.

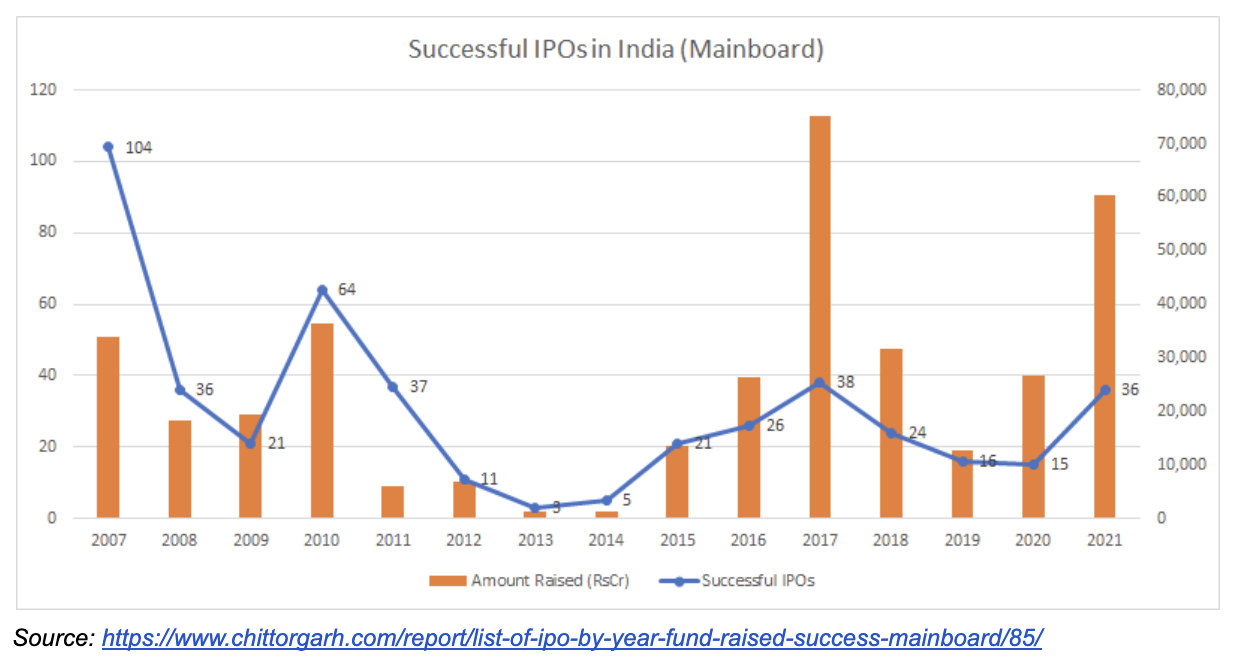

The second wave of IPOs came with the onset of the golden period of 2005–07. India witnessed over 100 IPOs in 2007, just before the onset of the global financial crisis. However, it has had a patchy track record since then.

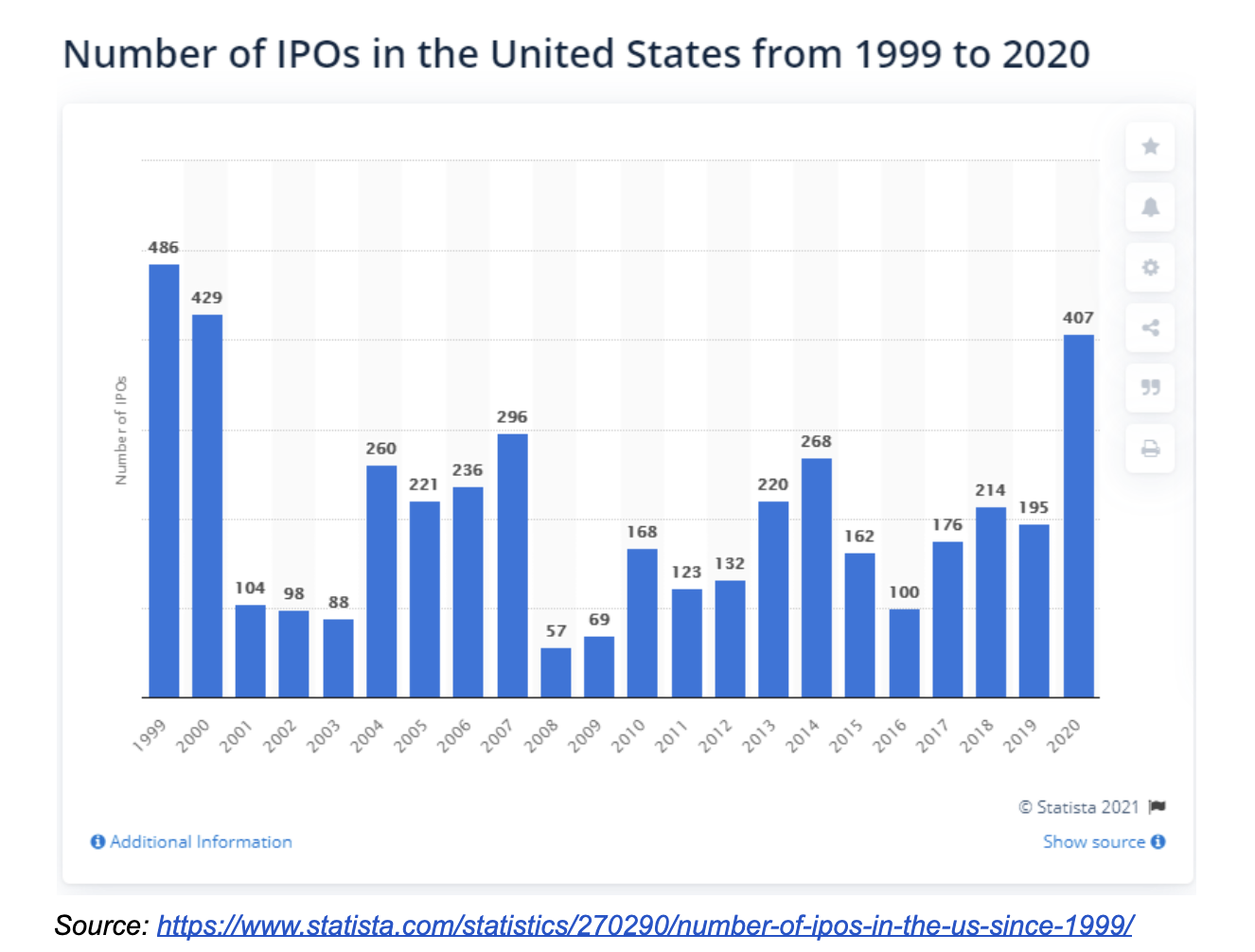

In comparison, a mature market like the US averages over 100 IPOs each year and over 400 IPOs each year in boom times.

The US, a USD 19 trillion economy growing at moderate levels, continues to witness strong IPO winds due to several factors. One is the participation of retail investors in equity capital markets. According to a survey of consumer finances by the Federal Reserve Board of the US, 52.6% of all families hold stocks either directly or indirectly. This has been holding stable at above 50% since 2001.

Contrast this to a high-growth market like India. A country with a GDP of USD 2.8 trillion, aspiring to be a USD 5 trillion economy in the next few years, growing at anywhere between 7% and 11% YoY, has buoyant equity capital markets largely driven by foreign institutional investors’ (FIIs) participation. FIIs are very important for the continued growth of the capital markets, and especially IPOs. A vibrant private equity market is enabling more and more companies to scale to levels that make them attractive for public offerings. A favorable regulatory environment is further aiding this transition. Despite all of this, it is interesting to note that retail participation in equity capital markets is abysmally low in India—less than 3% of Indian households have exposure to equities (directly or indirectly).

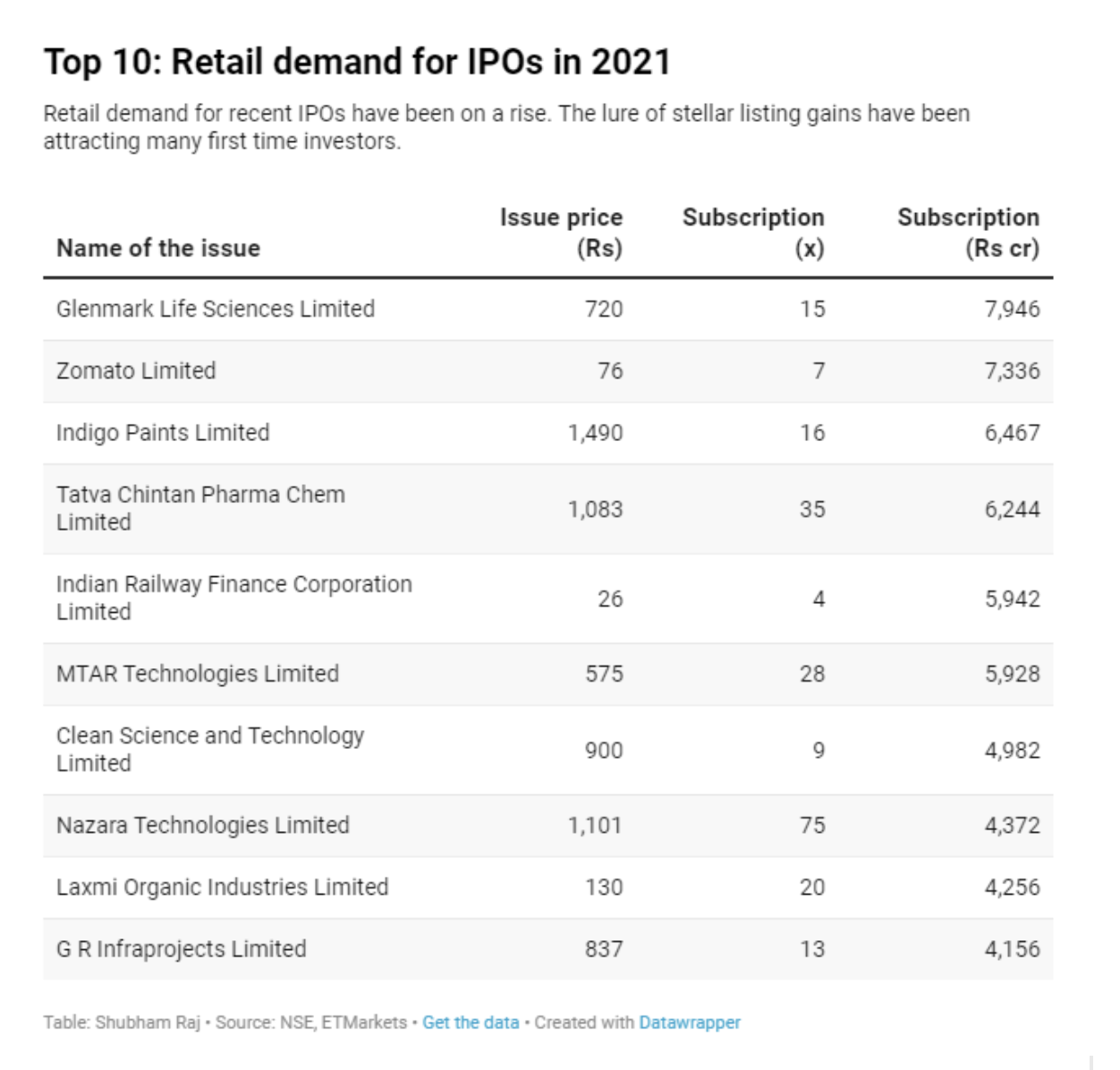

However, the silver lining is that a low-interest-rate environment, coupled with increased liquidity in the hands of investors, is driving a lot more retail participation in recent quarters. For instance, there were 55 million demat accounts by the end of FY 2021 compared to 5.8 million in 2007, and interestingly, only half of those actively participated in stock markets in 2007.

This is nearly a 10x increase in the number of demat accounts and potentially a more than 10x increase in the number of retail investors actively participating in the stock market. If recent IPOs are anything to go by, retail investor participation is scaling up significantly.

Positive changes in the regulatory environment are also forging IPOs as a sustainable path for scaled companies. The Securities and Exchange Board of India (SEBI) has been highly proactive in introducing numerous measures to set the stage for sustained growth of public offerings and equity capital markets.

The most recent was the reduction in lock-in period rules for promoters and pre-IPO investors of IPO companies—this was reduced from three years to 18 months under certain conditions. Further, the promoter’s shareholding in excess of the minimum holding is now locked for a period of six months instead of one year as per earlier rules. Similarly, profitability conditions have been relaxed to enable companies to access public markets more easily. Further, listing on foreign bourses at the same time as listing in India was also allowed last year.

Various news reports also indicate the possibility to allow Indian companies to list outside without listing in India—while most companies prefer to list in their home country (India), there will be a few (especially SaaS companies) better suited to list in the US directly—this also avoids the brain drain of SaaS companies setting up shop outside India. In totality, regulations are favoring sustained growth in IPOs and active equity capital markets.

Amidst all the frenzy and rosy outlook also lay the dangers of overexposure—retail participation can soon turn into a herd mentality, leading to unsustained growth of the markets (without fundamentals).

As a growing economy, India offers tremendous opportunities for entrepreneurs to build global companies. A very active early-stage VC ecosystem enables entrepreneurs to take that risk in the early stages, and a buoyant private equity market enables strong early-stage businesses to access growth capital. It is only natural to see a lot more IPOs in the future as these companies scale up. A knowledgeable and active public market ecosystem with active retail participation alongside FIIs is expected to make the country a solid story for the years to come.

About the author: Karthik Prabhakar is executive director and global head of fundraising at Chiratae Ventures India Advisors (formerly IDG Ventures India Advisors). He’s also responsible for leading investments in consumer media & tech and fin-tech sectors.