Bitcoin Inches Higher as Terra Starts Implementing Its USD 10B BTC Plan

Following Terra’s announcement in February that it would partly back its stablecoin UST with bitcoin (BTC), the market has been waiting for clues that Terra is in fact following up on its promise and buying BTC.

An indication that the stablecoin protocol is following through with its plan came this week, when a wallet believed to be belonging to Terra made a transaction of USDT 125m to crypto exchange Binance on March 21.

Following that, another transaction worth the same amount was spotted by the crypto trader Cantering Clark:

Terra foundation just sent another 125mil to Binance.

— HORSE (@TheFlowHorse) March 23, 2022

Last time they did this was right before they aped into BTC.

I plan on following. Will cut and re-evaluate if we lose these lows. pic.twitter.com/RYBr3DtVdL

Meanwhile, today, Bitcoin Magazine claimed that Terra had already purchased BTC 6,000 for USD 250m. Cryptonews.com has contacted Terra for comment.

The move to raise capital, originally amounting to USD 1bn, in order to buy a bitcoin reserve for UST has been backed by several notable investors, including crypto infrastructure provider Jump Crypto and the crypto-focused hedge fund Three Arrows Capital.

Until now, UST has been backed by Terra’s native token LUNA through an algorithm that adjusts the reserves according to market prices. At the time of writing, UST is the fourth largest stablecoin by market capitalization, per Coingecko.com.

USD 10bn plan to buy BTC

After Terra’s initial announcement, Terra founder Do Kwon said on Twitter that more than USD 10bn worth of BTC would eventually be purchased in order to back the stablecoin, although not all at once.

“It’s not 10bn today – as UST money supply grows a portion of the seigniorage will go to build BTC reserves bridged to the Terra chain. We have 3bn funds ready to seed this reserve, but technical infrastructure (bridges, etc.) is still not ready yet,” Do Kwon said in response to a question from Blockstream CEO Adam Back about where the USD 10bn is coming from.

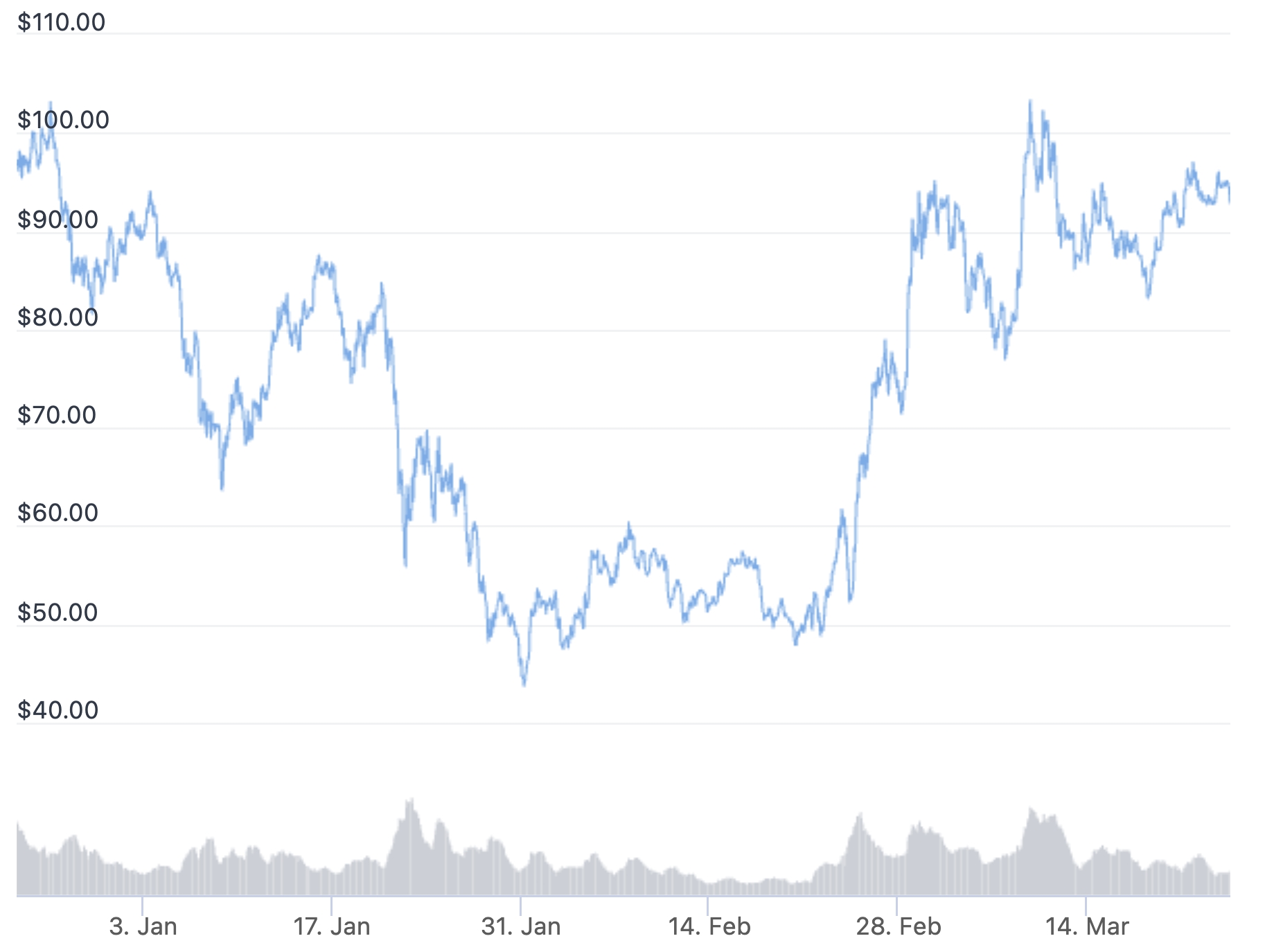

For Terra’s native LUNA token, the news that UST will be backed by a combination of LUNA and BTC rather than only LUNA appears to have been a bullish catalyst, with the token (as of Thursday at 13:05 UTC) up by a whopping 86% since the announcement.

Price of LUNA past 90 days:

The bigger question, however, is how such a buying spree could impact the price of BTC going forward.

Terra’s plan to build up a sizeable BTC reserve is already being compared to the strategy Michael Saylor’s MicroStrategy follows. The US-based firm has so far accumulated BTC 125,051 (USD 5.3bn), making it one of the largest holders of bitcoin in the world. Despite that, purchase announcements by MicroStrategy have largely gone without any major market impact.

Since Terra’s initial announcement of the new plan on February 22, bitcoin has traded higher, and is currently up by about 16% since the announcement. Notably, gains were also seen on the day of the announcement, when BTC rose by more than 3%.

As traders know, however, it is hard to say whether the price changes have anything to do with the announcement or not. All we know for now is that the more BTC that is bought up and locked away, the less will be available for the rest of us on exchanges.

The best take on the situation so far was perhaps given by Bitcoin developer Rajarshi Maitra on Twitter when asked how bitcoiners can come to terms with the fact that “shitcoiners are doing the biggest bitcoin buy in history:”

We don't.. Everybody gonna flock to Bitcoin eventually.. Its just not evenly distributed in time yet.. https://t.co/gl8qZz78ly

— Raj ⚡🌋 (@RajarshiMaitra) March 23, 2022

_____

Learn more:

– Terra’s Do Kwon Makes Massive Bet That LUNA Will Stay Above USD 88

– Luna Jumps as Terra Asks USD 38M From Community to Fund an Undisclosed Sports Partnership

– Whales Make Up More Than Half of Stablecoin Volume, Tether Losing Dominance

– Polkadot, Terra, ‘Most Promising’ for 2022, Pantera’s Morehead Says

– Russia Sanctions Means Countries May Transition to Bitcoin Reserves – Pantera’s CEO

– The Ukraine War: How Russia’s Aggression Affected Bitcoin & Crypto and What Might Happen Next