Ukraine Sells 1,282 War-Themed NFTs in One Day, G7 & Crypto Regulation, Metaverse Potential + More News

Get your daily, bite-sized digest of cryptoasset and blockchain-related news – investigating the stories flying under the radar of today’s crypto news.

_____

NFTs news

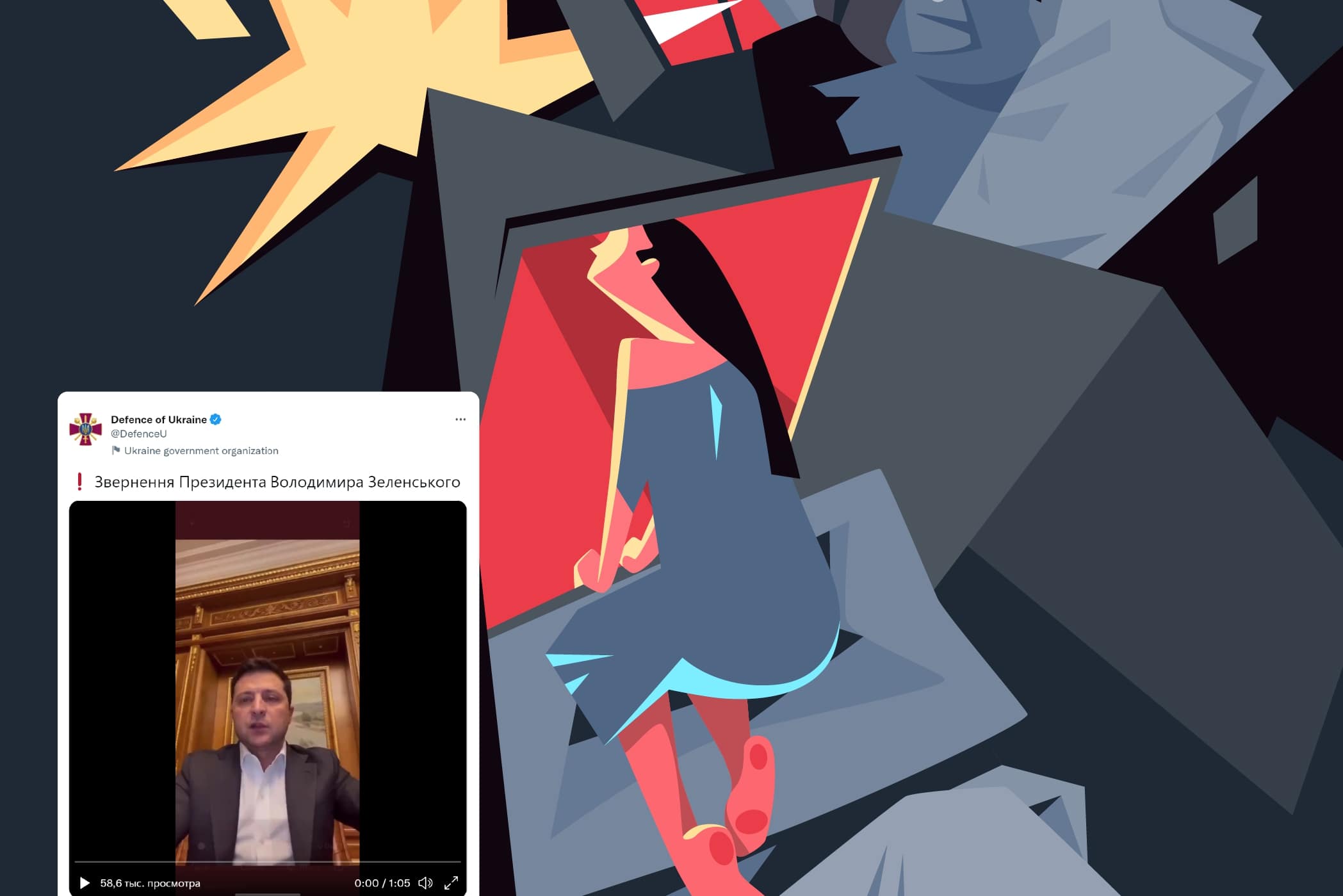

- Ukraine’s recently opened “NFT museum” – Meta History: Museum of War – has already sold 1,282 artworks, raising ETH 190 (USD 653,000), on the first day of the sales, per data from the Ministry of Digital Transformation. They are raising funds to rebuild the museums, theaters, and other cultural institutions destroyed by Russian occupiers. Moreover, the NFT-Museum team is preparing “a world auction, which will include the first 4 artworks of Ukrainian artists and the artworks of the winners of the international competition PROSPECT100.” Only owners of NFT from the Meta History Museum collection can take part in the auction, according to the ministry.

Regulation news

- The Group of Seven (G7) countries must speed up the creation of a common framework to regulate digital currencies, Kazushige Kamiyama, the head of the payment and settlement systems department at the Bank of Japan, told Reuters. He was quoted as saying that it wouldn’t be “very difficult to create an individual global settlement system” by using stablecoins.

- The US Securities and Exchange Commission (SEC) warned that companies listed in the country that act as custodians of cryptoassets on behalf of other companies should account for those assets as liabilities and disclose the risk associated with those assets to investors. The technological, legal, and regulatory risks can have a “significant impact” on the custodian’s operations and financial conditions, they said.

- India will frame legislation for cryptoassets only after a global consensus emerges on regulating such assets, Bloomberg reported, citing an undisclosed person familiar with the matter. For now, the government isn’t planning a law to either regulate or tighten provisions, per the report.

Metaverse news

- In their new report, financial giant Citi estimates the target addressable market (TAM) for the metaverse economy to be in the range of more than USD 10trn, while contributors to the report indicate a range of users of up to 5bn from the mobile phone user base, or just 1bn based on the virtual reality / augmented reality device user base. However, they added that to build an envisioned Metaverse experience, latency needs to improve and faster connectivity speeds are needed.

Security news

- Decentralized lending network platform Ola.finance was exploited, leading to a gain of around USD 3.6m for the hacker, while the protocol loss is even larger than that, blockchain security firm PeckShield said. The platform added that they took precautionary measures so that the attacker wouldn’t profit off the attack even more, and that they’re working on creating a compensation plan.

Investments news

- Investment management firm Galaxy Digital announced that shareholders of crypto custody specialist BitGo, which the former is in the process of acquiring, will now receive 44.8m newly issued Galaxy shares, up from 33.8m previously, resulting in BitGo holders owning 12% of the combined company versus 10% in the original deal. Additionally, the company said that its net comprehensive income increased 345% to USD 1.7bn in the 2021 fiscal year.

- The US Acting Comptroller of the Currency, Michael J. Hsu, said that banks looking at introducing bitcoin (BTC)-based futures and other derivatives should “carefully consider the tail risks”. He specified unreliable price histories, the current risk aggregation process, and the potential for wrong-way risk as the factors that should be considered.

- Bitcoin miner PrimeBlock announced its plan to go public through a merger with 10X Capital Venture Acquisition Corp. II, a special purpose acquisition company (SPAC), for an estimated enterprise value of USD 1.25bn. They added that in Q4 2021, PrimeBlock generated USD 24.4m of revenue, and had over 110 megawatts of installed data center capacity.

Blockchains news

- Chiliz (CHZ) announced that Scoville, the testnet for their Layer 1 blockchain, is now live. More details on the launch of the mainnet, called Chiliz Chain 2.0 (CC2), will be revealed shortly, they added.

- Blockchain platform Fantom (FTM) announced a new FTM 335m (USD 543m) Incentive Program in partnership with grant community Gitcoin Grants. They added that they will publish an eligibility policy listing all required criteria in a forthcoming blog post.

Legal news

- A Turkish prosecutor is pursuing jail sentences totaling up to 40,564 years for 21 of the founders and executives of the Thodex crypto exchange, per Bloomberg. The total losses due to the collapse of the exchange amounted to TRY 356m (USD 24m), it added.

Adoption news

- Blockchain domain name provider Unstoppable Domains announced that crypto platform Blockchain.com supports all of the former’s extensions, available natively on Brave and Opera browsers, and through browser extensions on Chrome, Firefox, and Edge. They currently offer nine domain extensions: .bitcoin, .coin, .crypto, .dao, .nft, .wallet, .x, .zil, and .888, with another one, .blockchain, coming soon.

Monetary news

- Gita Gopinath, the first deputy managing director at the International Monetary Fund (IMF), said the financial sanctions imposed on Russia due to its invasion of Ukraine threaten to gradually dilute the dominance of the US dollar and result in a more fragmented international monetary system, per the Financial Times. She clarified that while the dollar would remain “the major global currency even in that landscape”, fragmentation at a smaller level is already seen “with some countries renegotiating the currency in which they get paid for trade.”

Taxes news

- Indonesia plans to charge value-added tax (VAT) on cryptoasset transactions and an income tax on capital gains from such investments at 0.1% each, starting from May 1st, Reuters reported.