Fed Targets Inflation With Expected Half Point Hike, Will Reduce Assets

The US Federal Reserve (Fed) raised interest rates by 0.5 percentage points, to 0.75%-1%, in line with what analysts expected and what Fed Chair Jerome Powell has previously communicated.

“The invasion of Ukraine by Russia is causing tremendous human and economic hardship. The implications for the U.S. economy are highly uncertain. The invasion and related events are creating additional upward pressure on inflation and are likely to weigh on economic activity. In addition, COVID-related lockdowns in China are likely to exacerbate supply chain disruptions. The Committee is highly attentive to inflation risks,” the Fed said, adding that ongoing increases in the target range will be appropriate as they expect inflation to return to its 2% objective and the labor market to remain strong.

Also, the central bank decided to begin reducing its holdings of Treasury securities and agency debt and agency mortgage-backed securities on June 1.

Bitcoin (BTC) and ethereum (ETH) fluctuated right after the announcement, while stocks rose, the USD fell, and bonds also fluctuated.

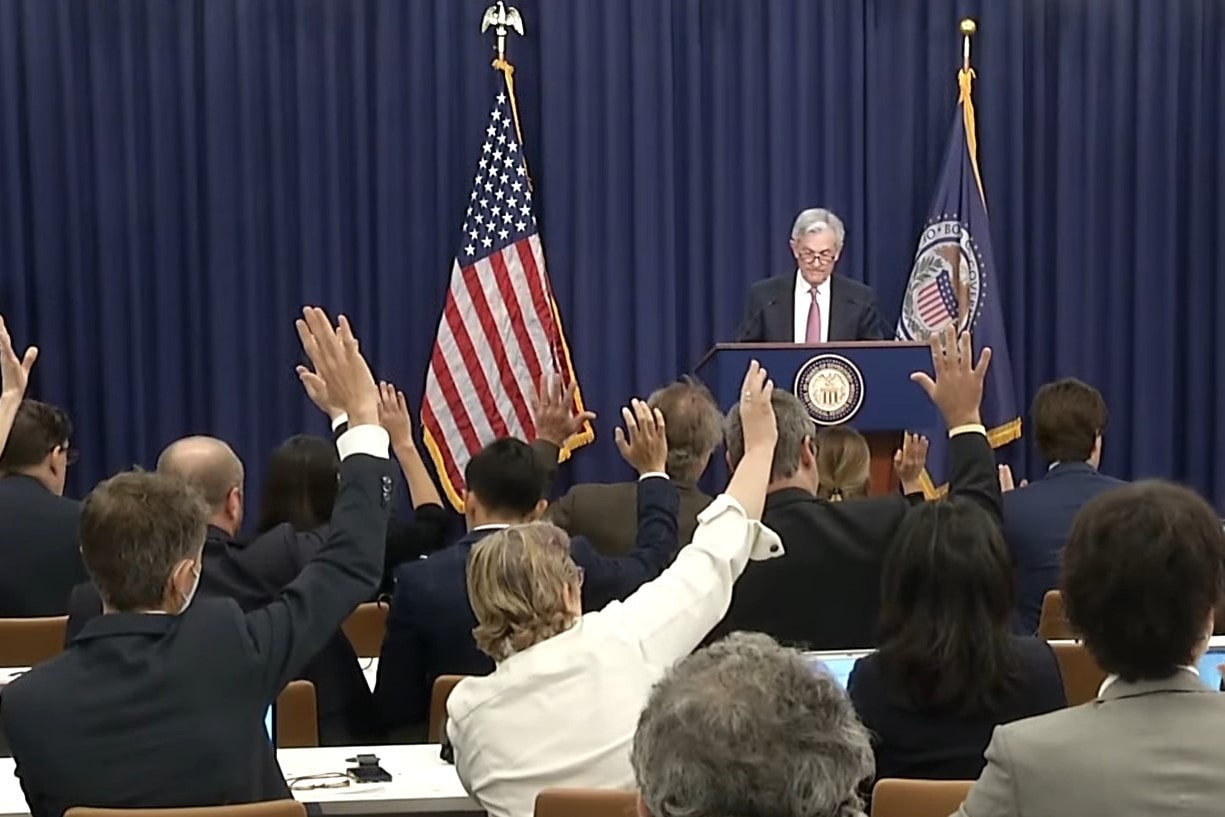

During his press conference today, Powell said that the 75 basis points increase “is not something we’re actively considering.”

https://www.youtube.com/watch?v=ELHQgcFBFpIThe decision today followed comments from Fed Chair Powell in late April, saying with regards to interest rate hikes that “it is appropriate in my view to be moving a little more quickly.” The comments came as the US is struggling with the highest inflation since the early 1980s.

According to multiple sources, including a Bloomberg report and an article by economist Mohamed A. El-Erian, interest rate swap traders have already fully priced in 50-basis point hikes for each of the next three Fed meetings – in June, July, and September.

If it were to materialize, such a hiking trajectory would be the most aggressive seen from the Fed in three decades.

Market watching for clues

Commenting ahead of the announcement from the Fed, Tony Farren, managing director at Mischler Financial Group, said traders are watching closely whether the central bank appears open to even more aggressive action, such as a 75-basis point hike, at its next meeting in June.

“The market would take that as hawkish. For his comments to seem dovish, he’d have to shut down the talk of 75 basis points. And while I don’t think he’ll endorse it, I don’t think he’ll shut it down,” Farren told Bloomberg.

Meanwhile, the legendary trader Paul Tudor Jones told CNBC on Tuesday that he is still “modestly invested” in crypto despite the challenging macro environment.

“Right now, I’m modestly invested and I would think that it’s going to have a bright future as we roll through these rate hikes,” Jones said, while adding:

“A lot of it depends on what our central bank does. A lot of it depends on how serious we are about fighting inflation.”

Writing on Twitter on Tuesday, the popular crypto trader and economist Alex Krüger appeared bullish given his view that “max hawkishness is almost fully priced in.”

“I lean bullish into what will be a very hawkish [Fed statement],” Krüger said, adding that the Fed can still surprise if it delivers tightening plans that are larger or faster than anticipated. “I see major bottoms everywhere, across [altcoins] & single name stocks. Just need a little help from the Fed,” the trader added.

A similar view was also held by the Singapore-based crypto trading firm QCP Capital, saying in a report on Tuesday that “we’ve possibly reached a short-term peak in fear,” adding that the bearishness in the market may be “slightly over-extended.”

“Our view is that the market has priced in rate hikes too aggressively which could then lead to the next few Fed meetings surprising on the dovish side,” the firm wrote.

Meanwhile, as reported, Credit Suisse analyst Zoltan Pozsar, who has previously said that BTC might move higher due to the war in Ukraine, estimates that higher oil prices are likely and that the government “will need a lot of money” to deal with these challenges. As a result of this, “the Fed will do [quantitative easing, QE] again by summer 2023,” the analyst concluded.

____

Learn more:

– Bitcoin Funds Sees Largest Weekly Outflows in a Year, ‘Hawkish Rhetoric’ to Blame

– Fed Tightening ‘More of an Opportunity Than a Threat’ – Grayscale CEO

– When Bitcoin Meets Inflation

– Why We Can’t Just ‘Stop Printing Money’ to Get Inflation Down

– Financial Stability Risks Grow as War in Europe Complicates Push to Contain Inflation

– Get ‘Mentally Ready’ for Lower Bitcoin Prices as Rates Rise, Bitcoin 2022 Panelists Warn

– Once the Fed Pauses, Bitcoin is ‘Going to the Moon,’ Novogratz Says