UK housing supply finally begins to build

Making sense of the latest trends in property and economics from around the globe.

4 minutes to read

Supply improves

Residential property listings have languished since the end of the stamp duty holiday in September, creating an supply/demand imbalance that has fuelled house price gains despite the fact that mortgage rates have risen sharply.

We now have solid signs that imbalance is beginning to ease, though there is some variation by location. New listings rose 19.2% between January and April across England and Wales, according to data from OnTheMarket. London saw an increase of just 5.7%, while listings jumped by a third in Wales.

Supply is building more quickly in rural rather than urban areas, which is driving the disparity with London. The 20 local authorities that registered the biggest increase in supply over the period were, on average, classified as 55% urban. For the bottom 20 areas (where supply fell), on average they were classified as 92% urban. See table below, with more detailed analysis here.

All roads lead to a further softening of house price growth. More than one in 20 homes for sale had their asking prices cut last month, with those cuts averaging 9%, according to Zoopla data out today. Annual price growth slowed modestly to 12.1% in April, according to Nationwide. The company will publish May's index on Wednesday. You can find our forecasts for house prices and rents over the next five years here.

US inflation cools

The volume of contracts to purchase existing homes in the US fell to a two year low in April, capping six straight months of declines.

Mortgage rates have risen sharply, draining much of the momentum from the market. Rising rates have raised the cost of purchasing a home by more than 25% compared to a year ago, with the steeper home prices adding another 15%, according to National Association of Realtors (NAR) estimates published by Reuters.

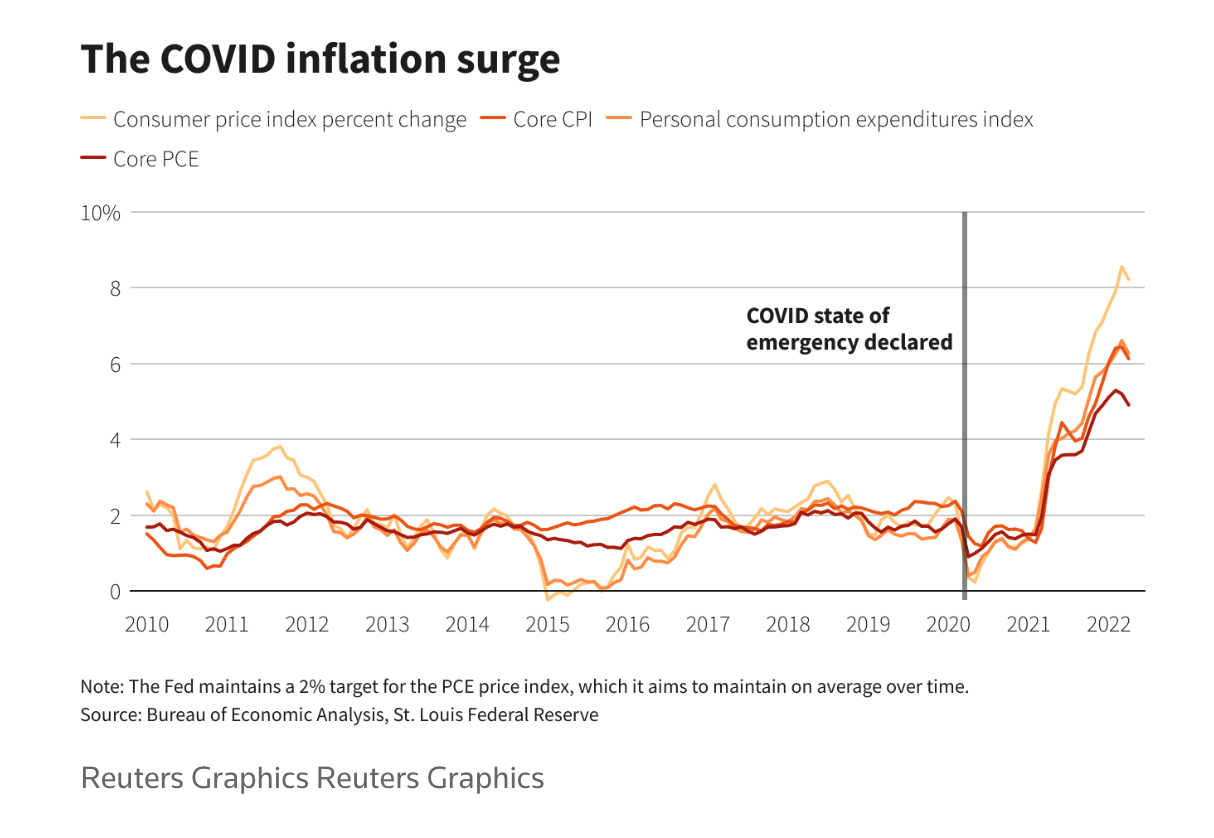

Housing market data is one of several indicators that suggest the US economy may be at a turning point. Growth in the personal consumption expenditures (PCE) price index, a key measure of inflation, slowed to 6.3% in April - the first deceleration since November 2020, according to official figures (see chart).

The Fed has been pretty unequivocal that we should be expecting several bumper rate hikes during the months ahead as it seeks to rein in inflation. Most participants at May's meeting were expecting as many as three half-a-percentage-point interest rate increases in the months ahead, however that was before solid signs emerged that inflation was beginning to cool...

Peak interest rates

Back in March the Bank of England shifted its stance from signalling bumper rate hikes might be necessary to something much more dovish. Energy prices will eventually stop rising and the squeeze in real incomes will put "significant downward pressure on domestically generated inflation," officials said at the time.

That is beginning to look prescient in the context of data from the US, though of course we'll have to wait for the latest readings of UK consumer price inflation. The BoE expects rising prices to peak in the final quarter before subsiding.

Money markets are easing back bets on where interest rates will peak in both the US and the UK amid the various signals that economic growth is slowing markedly. Current pricing suggests the US key interest rate will peak at 3% next June. Likewise, markets expect the Bank of England base rate to rise steadily until June 2023, taking it to 2.4%.

We've talked before about the degree to which various interest rate projections influence the outlook for house prices.

What EPC requirements?

We talked last week about the £25.7 billion bill faced by landlords that must ensure all newly let properties are rated at least EPC C by 2025. The deadline is 2028 for existing lets.

The government's official survey of landlords, published last week, builds on that picture. Just 15% of landlords said their homes were EPC C or above. The same proportion said they were unaware of the impending targets.

Some 11% said they intend to increase their portfolios, with 12% aiming to decrease, 10% selling out entirely and 48% staying at the same level. The impact of recent and forthcoming changes to legislation was the most cited reason for landlords choosing to decrease their portfolio size or leave the sector.

In other news...

Mortgage reform is key to unlocking UK home ownership (FT), the economy will count the cost of climate change (Times), and finally, China's Covid outbreak wanes (Bloomberg).