New Class Action Lawsuit Targets Solana In California

Solana Labs, the entity behind the Solana (SOL) blockchain, has found itself targeted by a new class-action lawsuit filed with a California court.

The suit accuses the company, along with a number of related persons and entities active within the ecosystem, of drawing illegal profits from the blockchain’s native token, and claims that SOL is an unregistered security.

“Defendants made enormous profits through the sale of SOL securities to retail investors in the United States, in violation of the registration provisions of federal and state securities laws, and the investors have suffered enormous losses,” according to the lawsuit initiated by California resident Mark Young.

Young claims he bought an undisclosed amount of SOL in August and September 2021.

The suit states that, during the class period which began on March 24, 2020, the defendants, who include Anatoly Yakovenko, the CEO of Solana Labs, made deliberately misleading statements in relation to the total circulating supply of SOL.

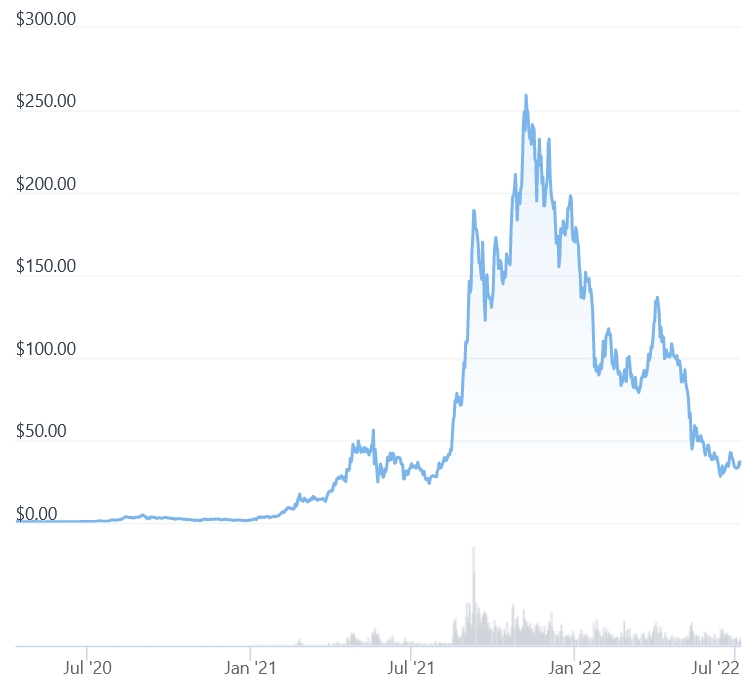

“Since April 2020, funded by the proceeds they made through their [initial coin offering], Defendants have spent vast sums of money promoting SOL securities throughout the United States. As a result of these promotional efforts, SOL securities reached a peak price of USD 258 per token, with a market capitalization of more than USD 77bn, on November 5, 2021,” according to the court documents. “These promotional efforts took SOL securities from a relatively obscure cryptoasset to one of the top cryptoassets in the world.”

The plaintiff requests a jury trial in California, seeking damages and a declaration that SOL is a security.

“Not later than August 5, 2022, which is sixty days from the date of publication of this notice, any member of the proposed class that is identified in Plaintiff’s complaint may move to the Court to serve as Lead Plaintiff through counsel of their choice,” Schneider Wallace, one of the two law firms which are representing the plaintiffs, said in a statement.

Solana Labs declined to comment when contacted by Cryptonews.com.

At 11:21 UTC, SOL, ranked 9th by market capitalization on CoinGecko, trades at USD 37 and is up 3% in a day. SOL is down almost 13% in a month and up 8% in a year. It’s also down 86% from its all-time high of around USD 260, reached in November 2021.

SOL price chart:

____

Learn more:

– Another Solana Outage Shows That Price Impact Is Minor

– Regulatory Fog Remains as SEC Chief Doesn’t Mention Ethereum as a Commodity, Does Not Say Bitcoin is the Only One Either

– SEC Chief May be Gunning for Crypto Exchanges and Altcoins

____

(Updated at 13:25 UTC to add that Solana Labs declined to comment when contacted by Cryptonews.com.)