Short Bitcoin ETF Sees Higher Trading Volume Last Week as Longs Liquidated

The recently-launched short Bitcoin (BTC) exchange-traded fund (ETF) BITI saw higher trading volumes last week compared to its launch week. The peak in volume so far happened as liquidations of leveraged bitcoin long positions reached its highest in close to two weeks.

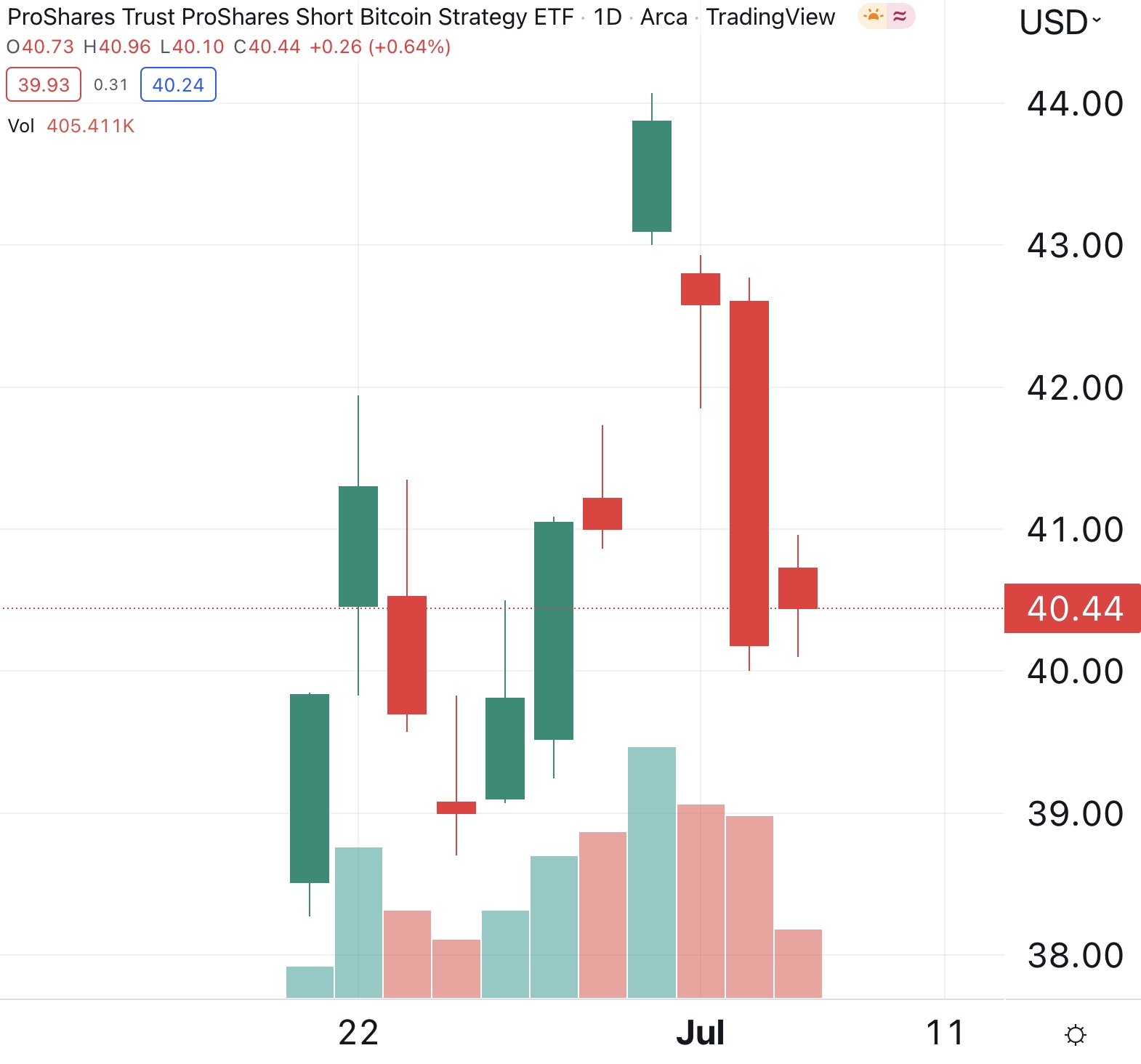

Judging from trading data from NYSE Arca and TradingView, more than 1.5m shares of BITI was traded on June 30, making up approximately USD 65.2m in trading volume. The day marked the peak in volume for the ETF so far, after somewhat muted interest from traders during the first week.

On its first day of trading on June 21, BITI saw just 183,284 shares traded, worth approximately USD 7m. That was followed by a spike to 870,000 shares, or USD 35m, on day two.

During its second week of trading, BITI saw its trading volume increase day by day, before a slight drop in volume on the last day of the week on July 1. Following the 4th of July holiday, the market opened again with high volume in the ETF on Tuesday the 5th, before interest in short bitcoin exposure fell markedly on the 6th, as bitcoin spot prices rose.

BITI price and volume:

Not surprisingly, perhaps, is that the trading volume in the short bitcoin ETF is relatively closely correlated to the spot price of bitcoin.

BTC spot price and BITI volume:

Worth noting, however, is that the ETFs trading volume on the first day made up only a tiny fraction of the USD 1bn in volume that was seen on the first day of trading for BITO, the first regular bitcoin futures-backed ETF to launch in the US.

In terms of total assets under management, BITI on Friday last week had a net short exposure equivalent of BTC 3,811 (approximately USD 75m), making it the second-largest US bitcoin-related ETF, Arcane Research said this week.

The third and fourth largest bitcoin ETFs in the US are the regular ‘long’ bitcoin ETFs from Valkyrie (BTF) and VanEck (XBTF), with total net assets of USD 18.5m and USD 17.8m.

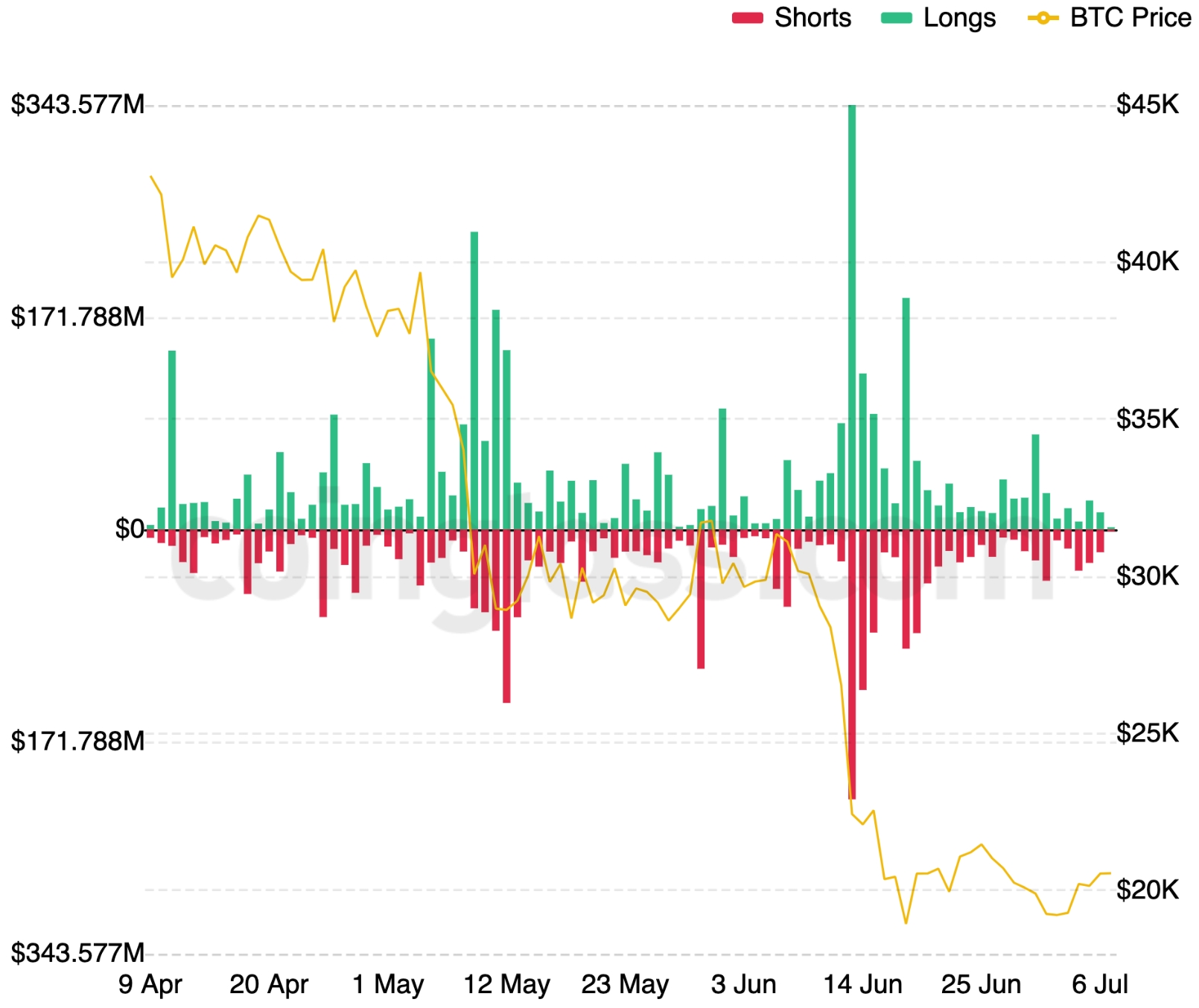

Volume peak coincides with long liquidations

The peak in trading volume for BITI that was seen on June 30 coincided with an uptick in liquidations of leveraged bitcoin long positions. According to data from Coinglass, long liquidations reached USD 75.8m on that day, the highest level in 12 days.

Leveraged BTC liquidations:

____

Learn more:

– Pressure on SEC Chair Rises as Even WSJ Accuses Gensler of ‘Holding Investors Hostage’ with Bitcoin ETF Stance

– Cautious Bullishness in Bitcoin & Crypto Amid Warnings of Further Downsides

– Don’t Fear the Reaper: Why the Market Downtrend Is Good for Crypto

– Bitcoin Lifeboat, Long Recovery Road, & Exaggerated BTC Deaths: Saylor, CZ, and Professor Weigh In