Listen to this article 3 min

The great SPAC retrenchment continues.

A year after the industry set records for the numbers of new special purpose acquisition companies launched as well as the mergers that involved them, many such blank-check entities continue to wither on the vine. The latest examples: a pair of SPACs with Bay Area ties.

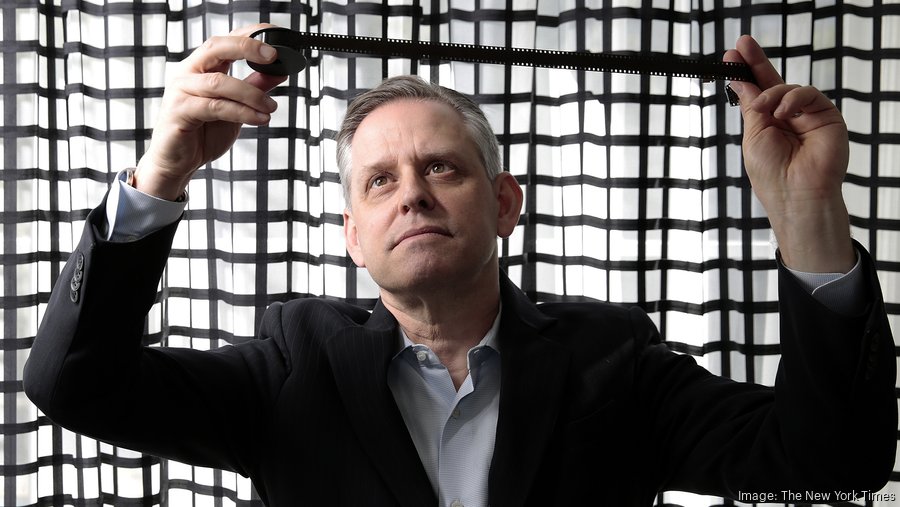

One, a Palo Alto-based SPAC founded by the former CEO of The Eastman Kodak Co., decided to shut down without completing a merger. The other, a Chinese SPAC that's trying to take Pleasanton-based ProSomnus Holdings Inc. public, asked shareholders for more time to complete the merger and announced a deal with a pair of investors to provide short-term financing to help it complete the deal.

The moves come as many of the SPACs that launched over the last two years are struggling to find merger partners. Such entities typically have 18 months to two years after their initial public offerings to complete a combination; if they don't, they have to hand back the money they raised in their initial public offerings to their investors.

But going public through such blank-check mergers has become far less attractive. The vast majority of companies that hit Wall Street through such combinations over the last two years have seen their share prices plunge. Some have either filed for bankruptcy or warned investors that they face having their shares delisted.

Here's more Bay Area investor and startup news at the beginning of the week:

Fundings

- StarTree Inc., Mountain View, $47 million: GCV Capital led the Series B round for this provider of cloud-based data analysis software. Sapphire Ventures, Bain Capital Ventures and CRV also participated.

M&A

- Light Street Capital Management announced it would vote against Zendesk Inc.'s planned acquisition by an investor group led by Permira Advisers LLP and Hellman & Friedman LLC. Palo Alto-based Light Street proposed instead to invested $2 billion in Zendesk (NYSE:ZEN) itself and have the San Francisco company borrow another $2 billion. The hedge fund also proposed that Zendesk spend up to $5 billion repurchasing shares. Hellman and Permira, private equity firms based in San Francisco and the United Kingdom, respectively, announced in June a plan to buy Zendesk for $77.50 a share, or about $10 billion.

- HP Inc. announced it has completed its acquisition of Poly. The Palo Alto computer company (NYSE:HPQ) paid $40 a share for Poly, legally Plantronics Inc. (NYSE:POLY) valuing it at around $1.76 billion, not including debt. Based in Santa Cruz, Poly offers phone headsets and video and phone conferencing hardware and software.

SPACs

- E.Merge Technology Acquisition Corp. (NASDAQ: ETAC) announced it plans to dissolve and return its cash to shareholders. The move follows its inability to complete a merger. In June, E.Merger shareholders extended its deadline to complete a combination from Aug. 4 to Nov. 4. The Palo Alto-based SPAC raised $600 million in a 2020 initial public offering, but investors redeemed about $272.5 million worth of its shares at its June shareholder meeting.

- ProSomnus Holdings Inc. announced $30 million in debt financing from led by Cohanzick Management and CrossingBridge Advisors. The funds from two Pleasantville, N.Y., asset firms are subject to and will help support the closing of ProSomnus' planned merger with Lakeshore Acquisition I Corp. (Nasdaq:LAAA). China-based Lakeshore is holding a shareholder meeting Sept. 7 to postpone its deadline to complete the combination — announced in May — from Sept. 15 to Dec. 15. Based in Pleasanton, ProSomnus is a maker of an oral device used to treat sleep disorders.

Funders in the news

- Y Combinator named Garry Tan to be its next CEO. Tan, a former partner at the firm and currently a managing partner at Initialized Capital Management, will replace Geoff Ralston, who is stepping down at the end of the year.

- Flourish Ventures named Tyler Mann as its legal head. The Redwood City firm also named John Onwualu as a principal. Mann was previously an associate counsel at Greenoaks Capital. Onwualu was most recently the co-founder and a managing partner at Afia Capital.

- Ubiquity Ventures is raising up to $60 million for its third fund. The Palo Alto firm focuses on early-stage software startups.

- Zetta Venture Partners of San Francisco named Dylan Reid and James Alcorn partners.