Mere months after widespread covid lockdowns in Shanghai disrupted supply chains and forced manufacturers to halt operations, China is again seeing an uptick in factory shutdowns.

This time, the culprit is not the coronavirus, but an intense heatwave and drought across China’s south, around the Yangtze river basin. Water levels behind dams are depleting, curbing electricity generation at hydropower plants, just as air conditioning demand is spiking.

To prevent power outages, authorities in Sichuan province—which relies on hydropower for about 80% of its energy needs (link in Chinese)—have ordered factories to halt operations.

China is shutting down its factories to save power

Data from Everstream Analytics, a supply chain data and risk analytics provider, show a sharp rise in factory shutdowns in China over the past week. As of Wednesday (Aug. 17), Everstream had recorded 39 closures—more than double the previous week’s total, even though the week was just half-over.

“It’s likely going to be equally impactful, if not more, than the lockdowns earlier this year” in Shanghai and nearby Kunshan, said Mirko Woitzik, global director of intelligence solutions at Everstream Analytics.

In part, Woitzik said, that’s because while covid-related factory closures can theoretically be targeted at areas where infections are high, and operations can gradually resume under “closed-loop” conditions, the effects of power shortages are more extensive and indiscriminate.

Some major manufacturers that have had to halt operations in Sichuan include the Japanese carmaker Toyota and CATL, the Chinese lithium battery giant.

Critical raw material companies have been hit too, and the effects will ripple through the supply chain. For example, Tongwei, the world’s largest supplier of polysilicon—a key raw material for solar panels—has suspended production, as has lithium producer Yahua Industrial (link in Chinese).

It’s not just China that’s grappling this week with the economic repercussions of high temperatures and dry spells.

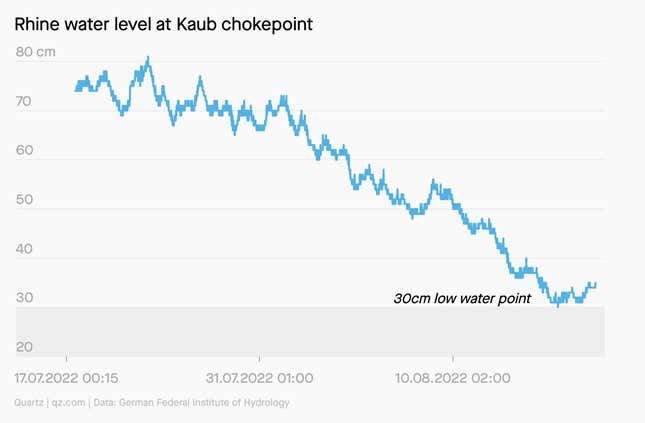

In Germany, the hot and dry summer has brought water levels on the Rhine—a key shipping route for Europe—to critically low levels, disrupting trade as the river becomes too shallow for many ships carrying commodities and fuels to pass.