The largest crypto exchange by volume (Binance) and the third-largest crypto exchange by volume (FTX) faced off in recent days after Binance CEO Changpeng “CZ” Zhao tweeted that his exchange would slowly withdraw billions of its holdings in FTX’s native token, FTT, “due to recent revelations that have came to light.”

But first, let’s take a few steps back.

Concerns surrounding FTX’s liquidity grew following a Thursday report from CoinDesk about the balance sheet of Alameda Research, a crypto trading firm once run by FTX CEO Sam Bankman-Fried. Alameda holds $14.6 billion in assets with $8 billion in liabilities as of June 30, CoinDesk reported.

The report showed Alameda’s largest asset was about $3.66 billion of “unlocked FTT” and $2.16 billion of “FTT collateral.” (FTT is the token behind FTX.) This means the $5.82 billion in total FTT that Alameda owns is equal to 193% of the total known FTT market cap, which is about $3 billion, according to CoinMarketCap data.

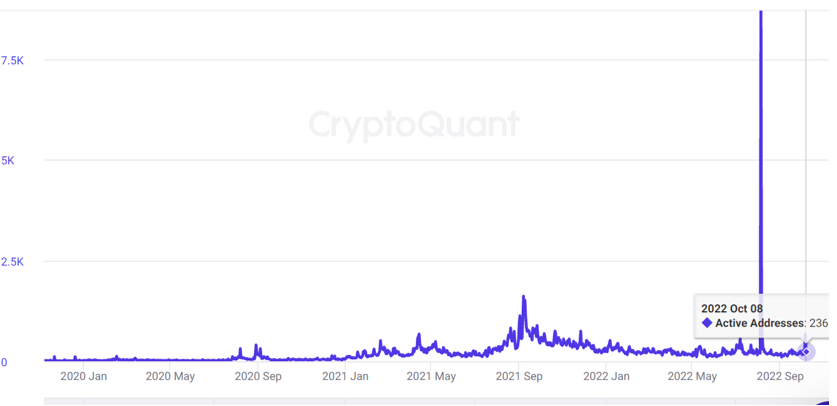

“The issue is that Alameda cannot sell even small amounts of their FTT holdings without heavily impacting the price,” Marcus Sotiriou, an analyst at the publicly listed digital asset broker GlobalBlock, said in a note. “Data from CryptoQuant [ … ] tells us that there are only around 200-300 active addresses trading the FTT token, which is very small in comparison to many other large caps. Hence, large sell orders would crash the FTT price, due to being illiquid.”

Then, on Saturday, roughly 22,999,999 FTT, worth about $584 million at the time, was transferred from a crypto wallet to Binance’s exchange, according to Etherscan. That is 17.2% of the total circulating supply of FTT, according to CoinMarketCap.

Looks like CZ is slowly dumping $500M worth of FTT on the market, if he continues many of Alameda's FTT backed loans will be liquidated causing a death spiral.

Let the party begin! pic.twitter.com/lKJ1zwr17S— Bitcoin vs. Gold (@VersusBtc) November 6, 2022

On Sunday, Zhao confirmed the transfer and announced that it was part of the exchange’s decision to liquidate its FTT holdings.

“As part of Binance’s exit from FTX equity last year, Binance received roughly $2.1 billion USD equivalent in cash (BUSD and FTT),” Zhao said in a thread of tweets, referencing the fact that Binance had an equity position in FTX from 2019 to 2021.

Zhao also said Binance will try to liquidate in a way that “minimizes market impact” and expects it to take a few months to complete. FTT has fallen nearly 14% in the past seven days from about $26 to a little over $22 at the time of publication.

In response to the liquidations, Alameda CEO Caroline Ellison tweeted at Zhao: “if you’re looking to minimize the market impact on your FTT sales, Alameda will happily buy it all from you today at $22!”

“Liquidating our FTT is just post-exit risk management, learning from LUNA,” Zhao tweeted later on Sunday. “We gave support before, but we won’t pretend to make love after divorce. We are not against anyone. But we won’t support people who lobby against other industry players behind their backs. Onwards.”

On Monday, Bankman-Fried tried to calm the waters in regard to FTX’s liquidity via a series of tweets indirectly responding to Zhao and Binance’s liquidations.

“A competitor is trying to go after us with false rumors,” Bankman-Fried said. “FTX is fine. Assets are fine.”

Bankman-Fried then went into details that FTX has enough to cover all client holdings and it doesn’t invest in client assets. He then tweeted he would “love” if Zhao and FTX could “work together for the ecosystem.”

Representatives from both Binance and FTX declined further comment when contacted by TechCrunch.

A handful of market players shared their thoughts on Twitter, though, arguing that they do not think FTX is insolvent. But the worries surrounding Alameda are notable, at the very least, as questions remain around Alameda’s liabilities and hefty amount of FTT holdings.