Risilience, a SaaS-based analytics platform that helps companies assess their climate risk and plan their transition toward net-zero carbon emissions, has raised $26 million in a Series B round of funding.

Spun out of the University of Cambridge’s Centre for Risk Studies (CCRS) back in 2021, Risilience says it has already amassed a number of high-profile enterprise customers, including Nestlé, Maersk, EasyJet, Burberry and Tesco.

The raise comes as ESG (environmental, social, and [corporate] governance) startups across the spectrum have continued to raise cash throughout the downturn, with climate-focused companies in particular apparently faring well. According to data from Bloomberg, venture capital (VC) and private equity funding found its way into 539 deals in the third quarter of 2022, just fractionally lower than the 547 climate-related funding deals in the preceding three months.

Separately, PwC’s State of Climate Tech 2022 report found that more than a quarter of every VC dollar spent in 2022 was targeted at climate tech, totalling around $15-20 billion per quarter — a figure that’s roughly comparable with the previous year.

There is, of course, good reason why climate tech has perhaps been a little more resilient to economic headwinds than other sectors. The global climate catastrophe is somewhere near the top of the agenda in many political and business spheres, with pressure mounting on corporations to address their carbon emissions and do their bit to counter their impact on climate change. And capturing the right kind of data and generating insights is central to this.

“Organisations are struggling to understand and quantify how climate risk affects their business financially, and plan their way to net-zero,” Rislience CEO Dr. Andrew Coburn explained to TechCrunch. “As we move to a low-carbon economy, businesses are faced with near-term transition risks, such as regulatory change and climate-related litigation; and long-term physical risks, like the floods and weather events.”

Digital twins

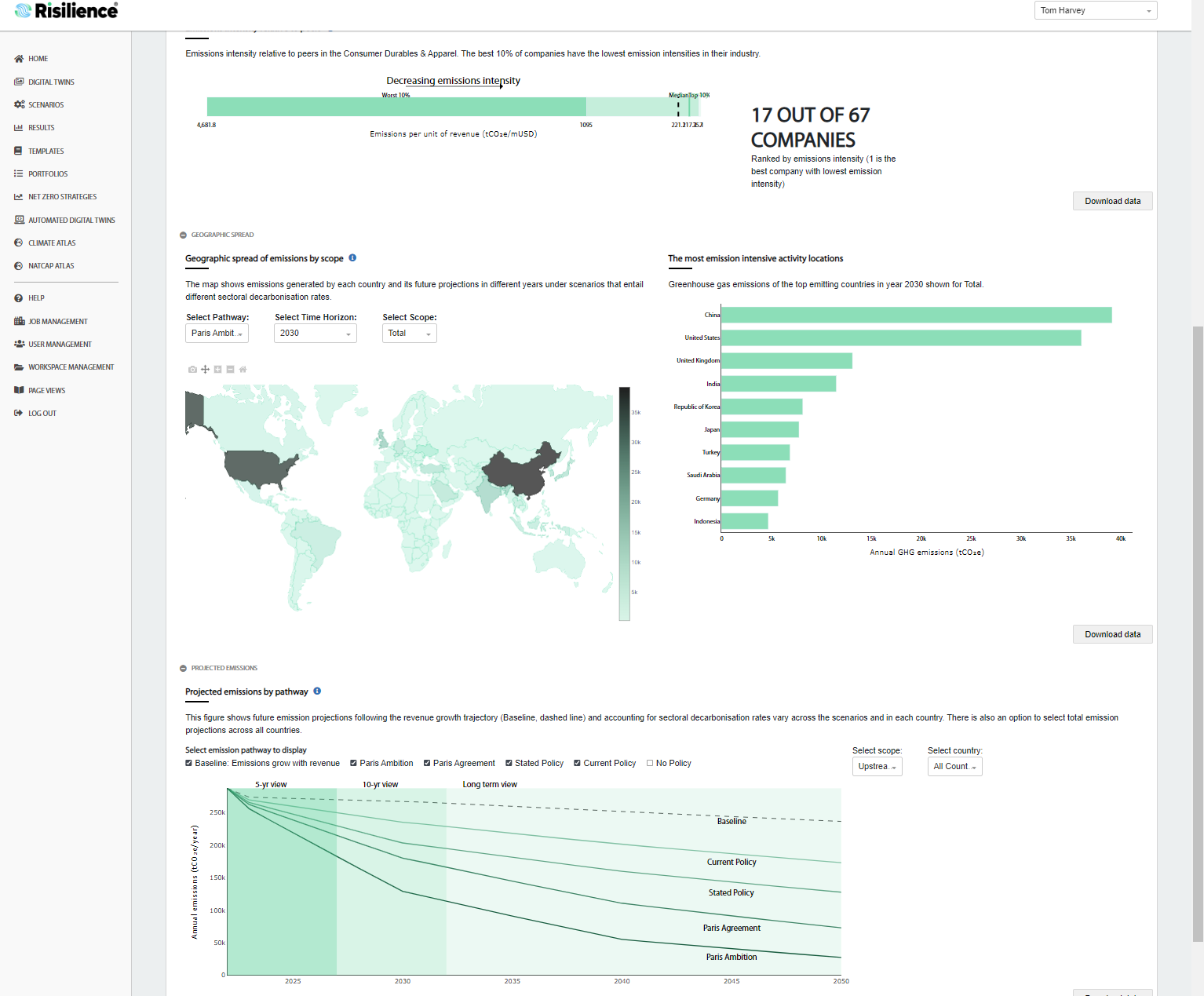

Risilience, in a nutshell, promises to enable companies to “turn data into actionable insights,” and measure the (potential) impact of climate-related risks to their business. For example, the company has built “digital twin” technology that allows companies to connect their own internal systems and databases to visualize and “stress-test” the impact of myriad “risks,” which in addition to weather events may include growing regulations, litigation and even evolving customer sentiment.

By way of example, the U.S. Securities and Exchange Commission (SEC) has proposed new rules that would require companies to report on any risks to their business related to climate change when filing updates for investors.

“Large organisations face a lot of challenges when it comes to disclosing their impact on the environment,” Coburn explained to TechCrunch. “With the threat of greenwashing, and increasing pressure from investors, reporting needs to be highly accurate but, with increasing regulatory pressures on businesses to disclose this information, they need to act fast.”

Risilience in action. Image Credits: Risilience

Ultimately, Risilience is all about helping companies move toward lower-carbon operations while minimizing the impact on profitability, and at the same time allowing them to report accurately to all stakeholders.

“Another common problem is that net-zero pledges are made with no detailed plan for how to get there,” Coburn added. “Risilience provides the crucial insight required in forming this plan that updates based on the ever-changing landscape organisations are facing.”

Prior to now, Risilience had raised £6 million ($7.4 million) in a Series A round back in 2021, and with another $26 million in the bank, the company said that it will use the fresh cash injection to drive international growth with a particular focus on the U.S. market.

Risilience’s Series B round was led by Quantum Innovation Fund, with participation from IQ Capital and National Grid Partners.